BP PLC (BP) (GB:BP) has announced the sale of its stakes in U.S. midstream assets for $1.5 billion, ahead of its upcoming third-quarter earnings release this week. The deal includes interests in the Permian and Eagle Ford regions, marking another step in the company’s ongoing efforts to streamline its portfolio and strengthen its balance sheet amid a shifting energy landscape. BP shares are up by 0.52% in London as of this writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Reason Behind BP’s Asset Sale

BP is selling parts of its oil and gas pipelines in the Permian Basin and Eagle Ford regions to funds managed by Sixth Street for $1.5 billion. After the deal, BP’s U.S. unit, bpx energy, will still keep 51% ownership in the Permian assets and 25% in the Eagle Ford assets.

The sale is part of BP’s plan to streamline operations and reduce costs under its $20 billion asset sale program, which is set to be completed by 2027. The company has been facing investor pressure after years of lagging behind rivals and drawing attention from activist investor Elliott.

For context, earlier this year, activist hedge fund Elliott Management built a nearly 5% stake in BP and has been urging the oil giant to scale back its green energy investments. In line with this push, Elliott has reportedly identified several assets that BP could divest as part of its broader restructuring effort.

What Lies Ahead for Investors?

BP will announce its Q3 2025 results on November 4. Wall Street analysts expect the energy company to report earnings of $0.76 per share in Q3, down from $0.83 reported a year ago.

Last month, BP released its third-quarter 2025 trading statement, indicating higher upstream production, driven by stronger gas output from its bpx energy and gas & low-carbon units. Oil production is expected to remain steady, with slightly higher exploration costs.

Additionally, the company’s third-quarter results are expected to include post-tax charges of $0.2 to $0.5 billion related to asset impairments, spread across multiple business segments.

Is BP a Buy, Sell, or Hold?

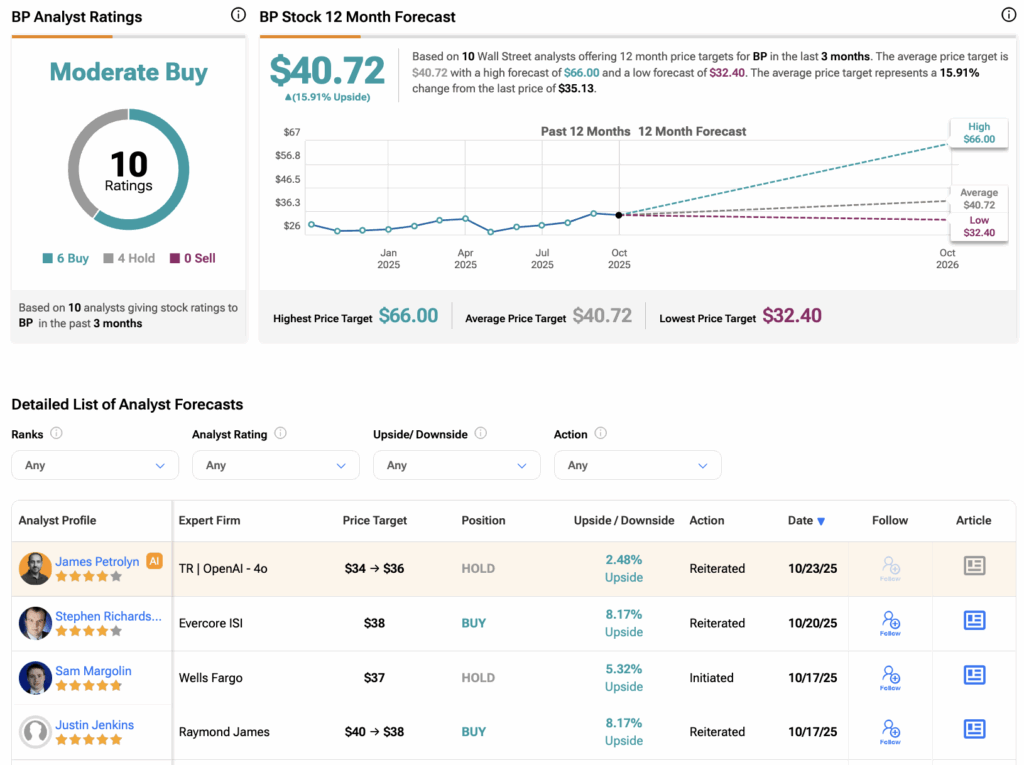

According to TipRanks’ consensus, BP stock has received a Moderate Buy rating based on six Buys and four Holds assigned in the last three months. The BP share price forecast is $40.72, which implies a growth rate of 16% at the current trading level.