Oil stock BP (NYSE:BP) made a huge jump forward in the green energy market earlier today, and investors weren’t all that happy about it. BP stock is down fractionally despite the fact that, now, BP will be a pretty major player in the electric vehicle infrastructure market.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BP’s advance comes from the fact that it just bought $100 million worth of Tesla (NASDAQ:TSLA) charging units. This, in turn, will give BP Pulse–BP’s electric vehicle charging network–an extra boost. It’s also the first time that Tesla hardware was bought specifically for an independent charging network, a development that might change, particularly as more gas stations will likely see the need to add electric vehicle charging stations or risk losing out on that business.

A report in The EV Report notes that BP plants to spread out the chargers geographically, including several major cities like Houston, Los Angeles, and Phoenix. Plus, they will also be available at several current gas stations, including Amoco and Thornton’s sites.

BP will also have a deal with Hertz to establish its chargers at the car rental office. Finally, BP looks to outfit the chargers with “Magic Dock” systems, including both NACS and CCS connectors, to ensure the widest possible range of recharge cases.

Is BP a Buy or Sell?

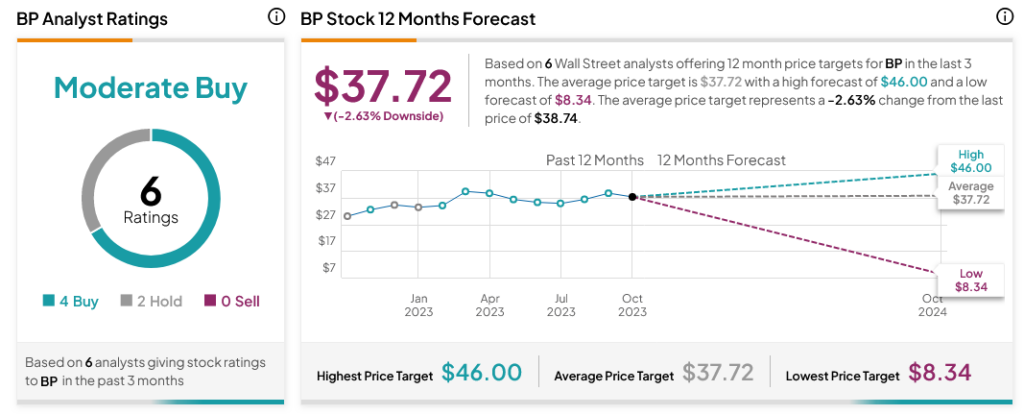

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BP stock based on four Buys and two Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average BP price target of $37.72 per share implies 2.63% downside risk.