While home improvement giant Home Depot (HD) really cannot be blamed for the use of its parking lots as live-traps for illegal immigrants, as it is not consulted about same, it is clear that people are not happy about Home Depot’s connection to illegal immigration. No matter how tangential it may be, it is still drawing ire. And indeed, boycott efforts are starting to pick up steam, a move that is not sitting well with shareholders. Shares slipped fractionally in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Fifty organizations recently hit MacArthur Park, and staged a march to the Home Depot location on Wilshire Boulevard. This was the site of several ICE enforcement efforts, as well as the big one, Operation Trojan Horse. This resulted in the Boycott Home Depot campaign, which is calling on Home Depot to “…publicly denounce immigration raids.” They also want “…the prohibition of all federal agents using Home Depot stores or parking lots as staging grounds….”

How exactly they hope to get that out of Home Depot is unclear at best. But they will continue to do so until Home Depot makes the desired changes. What is also unclear is the exact impact of these protests on Home Depot’s bottom line. Certainly, their boycott means they will buy nothing from Home Depot, but how much they were buying from Home Depot to begin with is, again, unclear.

Jim Cramer Talks Home Depot

Once again, Jim Cramer—controversial, or perhaps infamous, market analyst, depending on who you ask—came out to talk about Home Depot, and talked about its recent market gains. Basically, the gains came about as the result of hopes for a rate cut at the Federal Reserve, a move which President Trump has been actively clamoring for some time now.

Cramer elaborated, “And that’s why the housing stocks have had, just a [inaudible] yesterday, that indicated that you’re going to see gigantic explosion of housing starts…yesterday Home Depot was the star of the show. And that made sense to me. Because they told you this time it’s for real. And I think that this time Home Depot which has been nothing for a long time…go higher.”

Is Home Depot a Good Long-Term Buy?

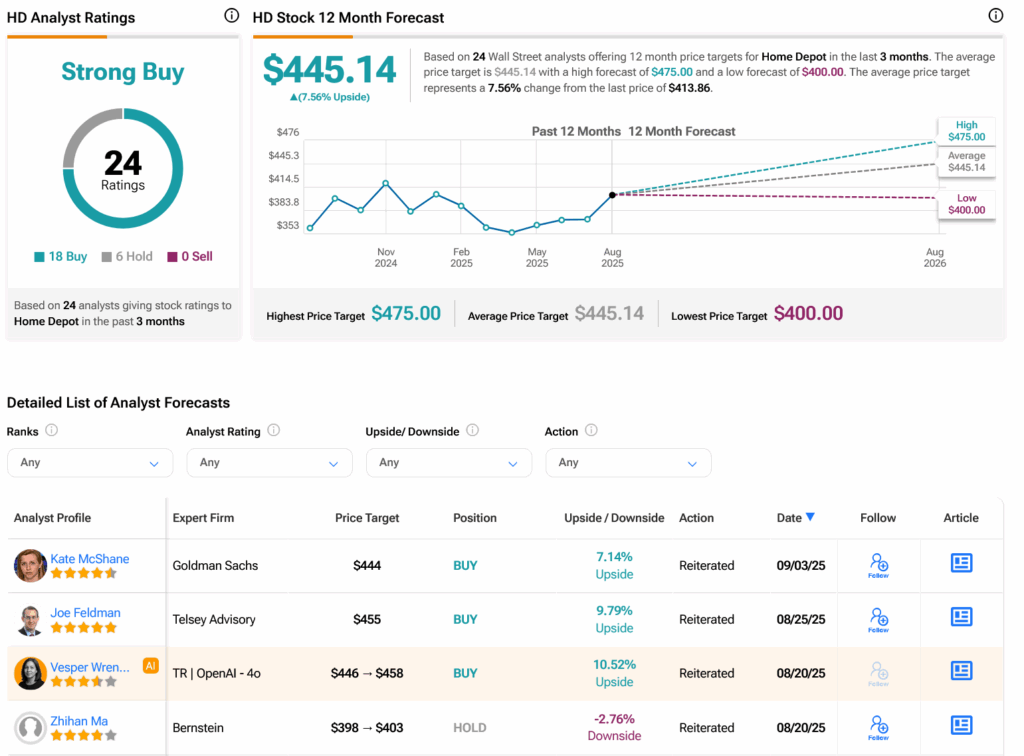

Turning to Wall Street, analysts have a Strong Buy consensus rating on HD stock based on 18 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 12.11% rally in its share price over the past year, the average HD price target of $445.14 per share implies 7.56% upside potential.