Things are not great at home improvement giant Home Depot (HD) these days, and not without reason. The fact that government agencies are basically using Home Depot parking lots as live-traps is problem enough, but word of layoffs in the supply chain is also doing Home Depot no favors. The combination of problems is hitting Home Depot hard, and sending shares slumping modestly in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Basically, a growing number of potential protesters is convinced that Home Depot has an obligation, somehow, to protect the people hanging around in its parking lots who may be in the country illegally but want to make a living regardless. And they are prepared to back their assertions by refusing to shop there.

From there, things start to get fractured, as the people convinced that Home Depot should be “doing something” immediately begin to debate just what that “something” is. For instance, what kind of protection should Home Depot extend to, say, customers who walk in and out of stores who are arrested over matters of “mistaken identity”? And what can the company even do about any of this? Home Depot has made it clear numerous times that the government does not involve Home Depot in decision making, so can Home Depot even do anything to begin with?

Then The Layoff Concerns Hit

It got worse from there, as the word we brought out recently about Home Depot’s planned closure of an HD Supply outlet near La Vergne, Tennessee prompted concerns about its overall supply chain. Some might call these concerns overblown; after all, the La Vergne closure is only partially a closure. The operation being closed is instead being incorporated into a second operation in the same town, which suggests some duplication of effort.

Still, the concerns that emerged at the time—shutting down any part of logistics suggests a reduced demand for it—seem to be gaining ground. This is particularly true given that there were signs that consumers were starting to take on home improvement projects again, of the kind that commonly required loans to accomplish. Throw in the holiday shopping season arriving, when Home Depot should need a supply chain running full-tilt, and the end result is unnerving for investors.

Is Home Depot a Good Long-Term Buy?

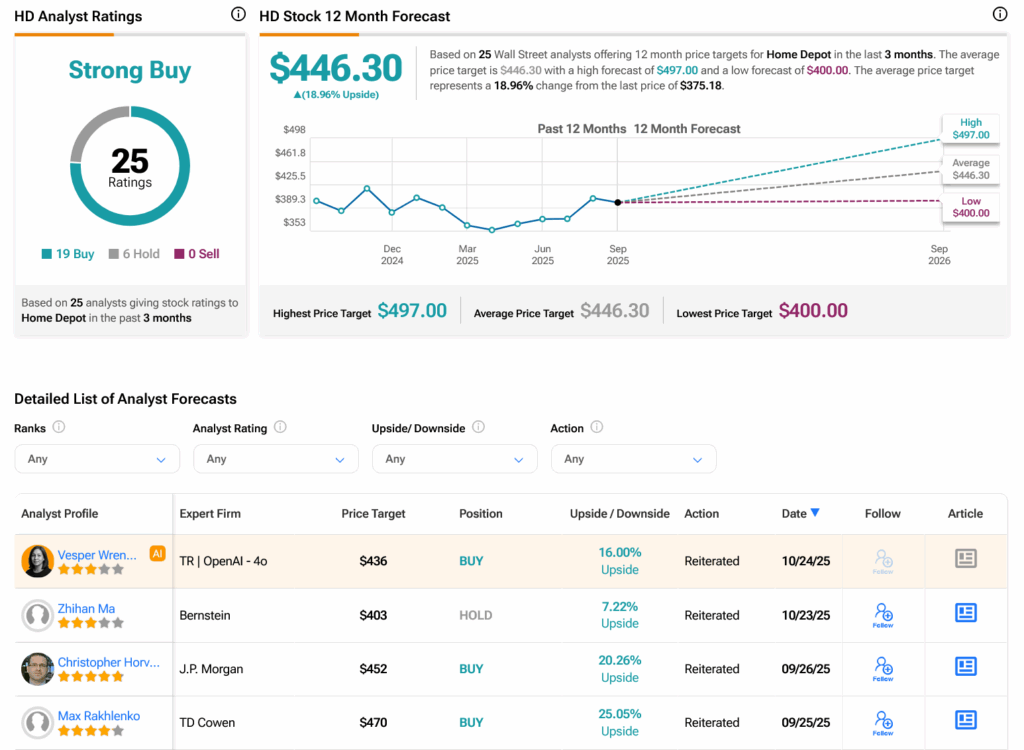

Turning to Wall Street, analysts have a Strong Buy consensus rating on HD stock based on 19 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 4.04% loss in its share price over the past year, the average HD price target of $446.30 per share implies 18.96% upside potential.