Shares of bowling entertainment company Bowlero Corp. (NYSE:BOWL) are up by double digits today after it completed a $432.9 million transaction with VICI Properties (NYSE:VICI). The sale-leaseback deal involves the transfer of land and real estate assets of 38 bowling centers across 17 states.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company plans to utilize the proceeds for new builds, paying down debt, general corporate purposes, and capital deployment into acquisitions and conversions. The lease will be for an initial term of 25 years, with an annual rent of $31.6 million. The rent will increase at the greater of 2% or CPI, and Bowlero expects to treat the lease as a long-term lease obligation (meaning no impact on EBITDA).

With nearly 350 bowling centers and a portfolio of brands, including Lucky Strike, AMF, and Bowl America, Bowlero caters to over 30 million visitors annually. Amid a challenging macro environment, shares of the company have dropped by over 24% over the past year.

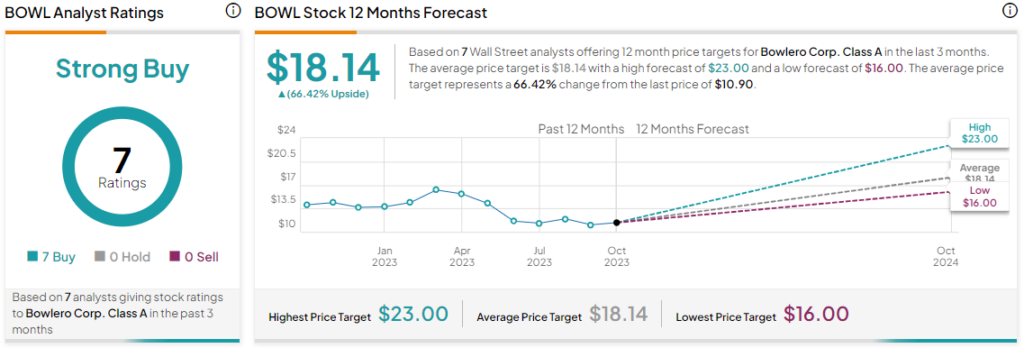

What Is the Price Target for BOWL Stock?

Overall, the Street has a Strong Buy consensus rating on Bowlero. The average BOWL price target of $18.14 implies a mouth-watering 66.4% potential upside.

Read full Disclosure