Shares of mobility solutions provider BorgWarner (NYSE:BWA) are ticking higher today after the company announced a joint venture with China’s Shaanxi Fast Auto Drive Group. This move is expected to expand BWA’s product offerings for electric and hybrid commercial vehicles. Shaanxi is a leading commercial vehicle parts supplier in China.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The two partners will work on the development of a high-voltage inverter application targeted towards high-efficiency vehicles. BWA’s strong engineering presence in China could help the company expedite the development-to-commercialization timeline for this inverter technology.

The JV remains subject to regulatory approval, and BWA expects to establish the venture in the first quarter of this year.

Separately, BorgWarner is scheduled to report its fourth-quarter results on February 8. Analysts expect the company to generate an EPS of $0.91 on revenue of $3.56 billion for the quarter. In the comparable year-ago period, WBA’s EPS of $1.11 had comfortably cruised past estimates by $0.16.

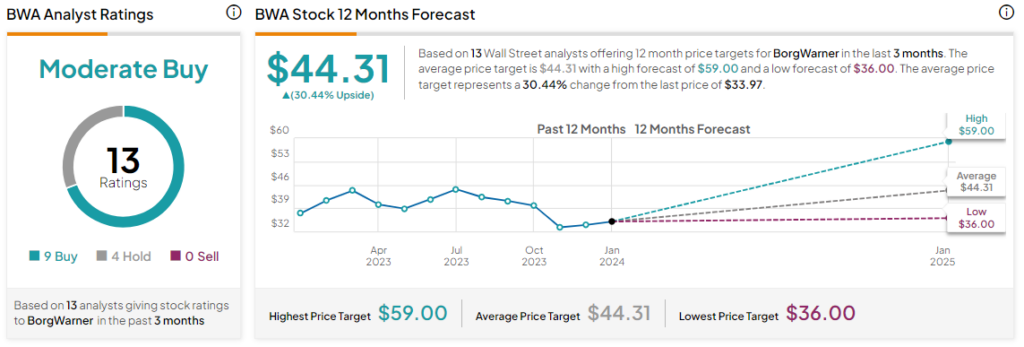

What is the Forecast for BWA Stock?

Overall, the Street has a Moderate Buy consensus rating on BorgWarner. After a nearly 8% slide in its share price over the past year, the average BWA price target of $44.31 implies a 30.4% potential upside in the stock.

Read full Disclosure