Shares of solar company SolarEdge Technologies (NASDAQ:SEDG) jumped in today’s trading after Bank of America upgraded the stock from Sell to Hold with a $29 price target. The upgrade suggests that the stock has already priced in a worst-case scenario that includes inventory write-downs and difficulties in monetizing its balance sheet.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Nevertheless, BofA analyst Dimple Gosai remains cautious despite an appealing valuation that’s near five-year lows. This is because the company is witnessing softening residential demand. In addition, the European market’s inventory challenges, along with weaker U.S. demand, suggest that weak sales could persist through the year, with profitability potentially returning in the first half of 2025. As a result, the analyst wants a clearer path to margin and cash flow recovery before becoming more bullish.

It’s worth noting that, so far, Gosai has enjoyed a 100% success rate on ENPH stock, with an average return of 52.4% per rating.

Is SEDG Stock a Good Buy?

Overall, analysts have a Hold consensus rating on SEDG stock based on five Buys, 16 Holds, and three Sells assigned in the past three months. After a nearly 90% decline in its share price over the past 12 months, the average SEDG price target of $53.06 per share implies 95.43% upside potential.

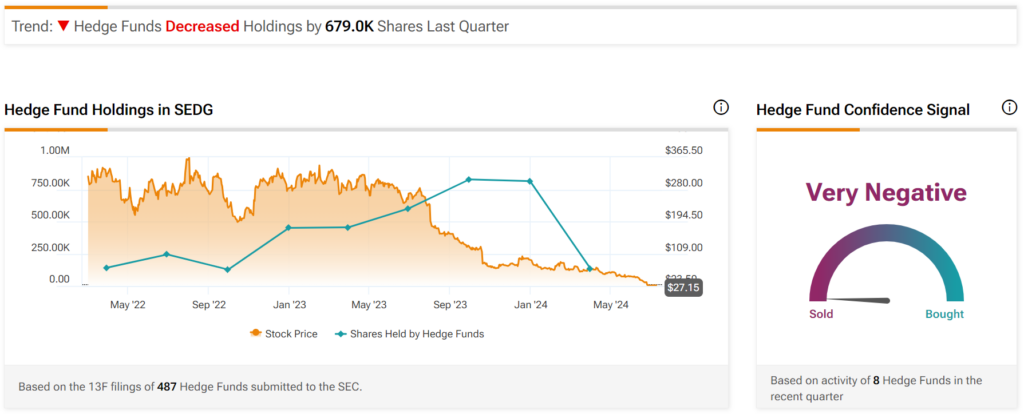

However, when it comes to “smart money,” money managers are even more pessimistic about SEDG stock. Indeed, hedge funds decreased their holdings in the stock by 679,000 shares in the past quarter. As a result, they have a very negative confidence signal, as indicated by the graphic below.