Meta’s (META) new search engine project isn’t an immediate threat to big players like Google (GOOGL) or Bing (MSFT), but Bank of America (BofA) sees it as a sign that competition is heating up in the search world. Five-star analyst Justin Post, as well as analyst Nitin Bansal, noted that Meta’s move could put some pressure on Google’s core business. Interestingly, investors seem to like the idea of increased competition, as all three stocks are up in today’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Meta’s search feature will work through its AI chatbot, which will pull answers from the web and is already available across Facebook, Instagram, WhatsApp, and Messenger. With users spending a lot of time on these apps (around 40 minutes daily on Facebook and 60 on Instagram), it could slowly pull some traffic away from Google if users start using Meta AI for search. BofA also pointed out that Meta has strong AI tools, such as its Llama model, which makes it well-prepared to develop its own search capability.

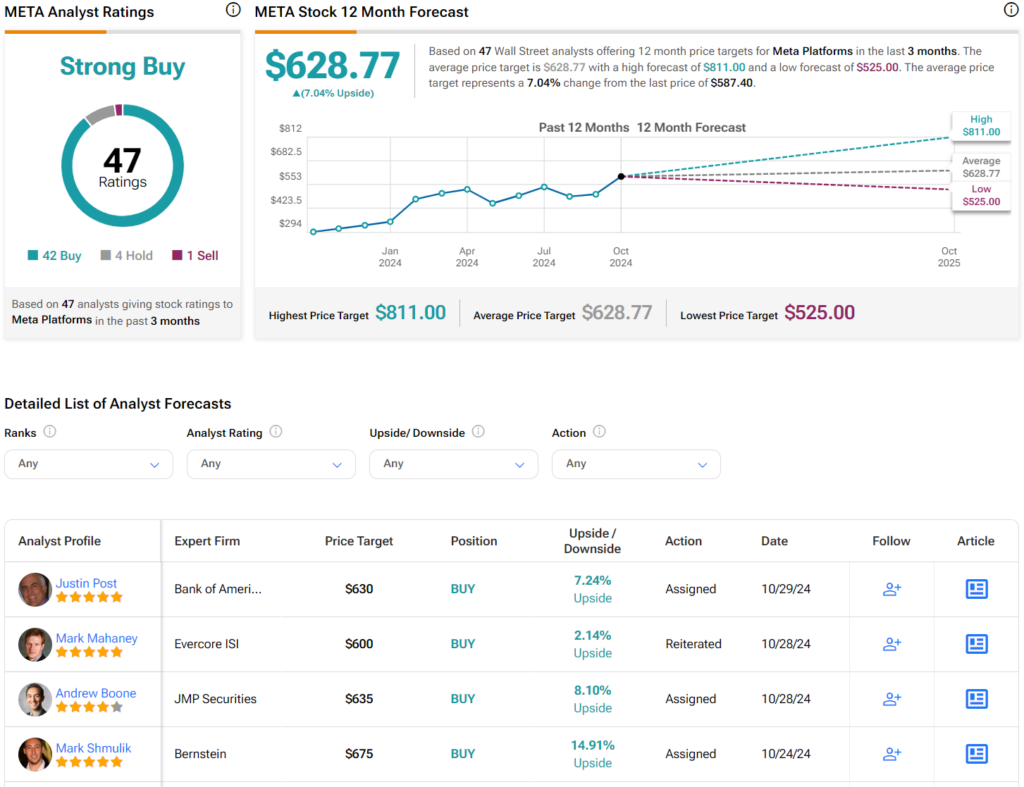

In addition, Meta’s huge user base, along with a massive cash pile that’s larger than that of newer AI companies like OpenAI, could provide it with a real competitive edge in search. It’s worth noting that, so far, Post has enjoyed a 77% success rate on META stock, with an average return of 25.85% per rating. Currently, he has a Buy rating on the stock with a $630 per share price target.

Bad Timing for Google

The timing of Meta’s new search engine could not be worse for Google. In fact, a recent federal ruling found that Google holds an illegal monopoly in the search market, and one of the potential remedies being considered is its breakup. It is possible that this ruling against Google might have actually emboldened Meta to take up this project by seeing it as a potential gateway into the search market.

Indeed, if Meta’s search engine catches on and Google gets broken up, it could be a double whammy against Google, as it would become less competitive at a time when a major rival has the technological capabilities to challenge it. Nevertheless, it will be interesting to see how this will play out.

Is META Stock a Buy?

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 42 Buys, four Holds, and one sell assigned in the past three months, as indicated by the graphic below. After a 95% rally in its share price over the past year, the average META price target of $628.77 per share implies 7% upside potential.