As Nvidia (NVDA) prepares to release its Q2 earnings results on August 28, both Bank of America (BofA) and Morgan Stanley weighed in with their perspectives, which caused the chipmaker’s shares to tumble. BofA warns that investors might be underestimating the risk of a potential earnings miss and suggests hedging against this risk by purchasing S&P 500 (SPY) puts rather than Nvidia-specific options.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It argues that S&P 500 puts are cheaper and offer protection against broader market drivers like upcoming economic reports. BofA also highlighted that Nvidia has been a major driver of the S&P 500’s returns this year, so any negative reaction to its earnings could have a ripple effect across the market. However, the firm isn’t bearish on the stock, as it has a Buy rating with a $150 price target. It is simply providing advice on how to reduce potential volatility.

On the other hand, Morgan Stanley was more upbeat and focused on Nvidia’s guidance. Despite a slight delay in the upcoming Blackwell GPUs, Morgan Stanley expects strong demand for the H200 chip, which will likely be the main driver of Nvidia’s guidance.

Additionally, Morgan Stanley is optimistic about Nvidia’s presence in China due to its H20 GPU. It noted that while the H20 has lower gross margins, it is still expected to generate significant revenue over the next few quarters, which will continue to support Nvidia’s growth. As a result, Morgan Stanley reiterated its Buy rating on Nvidia with a $144 price target.

What Is the Target Price for NVDA?

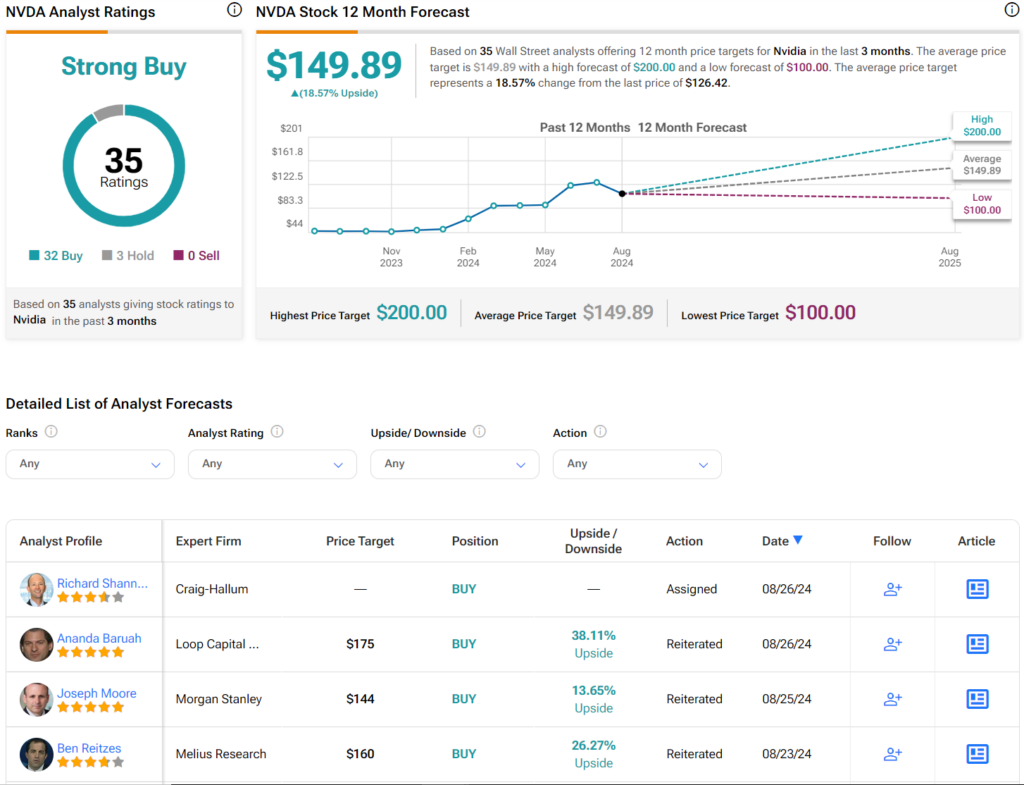

Turning to Wall Street, analysts have a Strong Buy consensus rating on NVDA stock based on 32 Buys, three Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 176% rally in its share price over the past year, the average NVDA price target of $149.89 per share implies 18.57% upside potential.