Amid growing US-China tensions, Boeing (NYSE:BA) will now be potentially selling its 737 MAX jets ordered by its Chinese clients to the India-based Air India carrier, as reported by Bloomberg.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The India-based airline company has a new owner in India’s largest conglomerate, the Tata Group, which is looking to upgrade its fleet of aircraft and may order 300 new aircraft. Tata Group may be the potential customer for 140 planes that are not allowed to deliver in the Chinese territory.

Boeing is also in talks with other potential customers about selling its unsold aircraft made for Chinese customers. Since 2019, Boeing has been stopped from delivering the 737 MAX to China following two fatal crashes.

Separately, the Federal Aviation Administration (FAA) has stated that key documents submitted for the ongoing certification review of the 737 MAX 7 are incomplete, especially those related to cockpit crews’ potential reactions to catastrophic hazards.

Hence, the agency has asked Boeing to further review its safety paperwork for the 737 MAX 7. This comes as one more blow to Boeing’s efforts to seek approval for its 737 MAX 7 before the year-end deadline set earlier by the regulators.

Is BA a Buy or Sell?

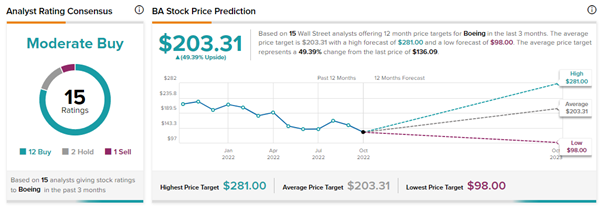

As per TipRanks, analysts are cautiously optimistic about the BA stock and have a Moderate Buy consensus rating, which is based on 12 Buys, two Holds, and one Sell. Boeing stock’s average price forecast of $203.31 implies 49.39% upside potential.

Concluding Thoughts

It is a strange contradiction that, on one hand, Boeing is struggling to meet timely deliveries of its ordered aircraft due to labor and supply constraints to the airlines across the world. On the other hand, it still has old, undelivered aircraft. Separately, its struggle with the 737 MAX 7 review process continues.

However, given the increased demand for aircraft as a result of increased travel demand, Boeing should be able to find more takers for its undelivered aircraft built for China. The company is scheduled to report its Q3 results on October 26.

Read full Disclosure