Boeing (NYSE:BA) stock has been struggling to keep pace with the broader market. Since early September, shares have fallen about 6%, while the S&P 500 has climbed 7%. With Q3 results due out tomorrow, J.P. Morgan’s top analyst, Seth Seifman, believes the recent weakness reflects investor caution heading into the report.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Seifman, who’s ranked among the top 3% on Wall Street, thinks part of this is down to expectations of a potential multi-billion-dollar charge related to the 777X program, based on management commentary and recent press reports.

The potential size of a Q3 777X charge is still uncertain, however. The charge would likely result from a delay in the aircraft’s entry into service, mainly due to testing and administrative work with the FAA that is taking longer than anticipated. At an investor conference last month, CEO Kelly Ortberg noted that even a little delay could have “a pretty big financial impact.” Ultimately, the length of the delay will determine the size of the charge. “Finger in the wind,” says the 5-star analyst, the 777X charge will be $4 billion.

Seifman believes the “key” for Boeing stock is a significant increase in FCF (free cash flow) over the next several years, but estimating this growth for 2026 is difficult from the outside, and management appears unlikely to provide detailed commentary before January’s Q4 call.

With the 777X delay pushing out cash flow, Seifman has lowered his 2026–27 estimates. On top of higher losses on the first 500 aircraft, the delay also postpones customer deliveries and advance payments. Although this is primarily a “timing issue,” it can significantly affect cash flow in a specific period. For example, Seifman’s model now excludes 10 777X deliveries in 2026, meaning it assumes no deliveries next year.

On the positive side, a key factor supporting higher free cash flow is the rise in 737 and 787 deliveries, and Boeing is continuing to make progress on both aircraft. Q3 737 deliveries were “up nicely,” and the FAA has approved raising production to 42 per month.

As such, ahead of the earnings report, Seifman is “penciling in” a $4 billion 777X charge, though this is expected to have little impact on cash flow for the current year. However, to reflect a delayed 777X ramp, the analyst has reduced his 2026–27 cash flow projections to $3.75 billion and $8.5 billion, respectively (each down $500 million). That said, Seifman still sees “nice growth beyond 2027.”

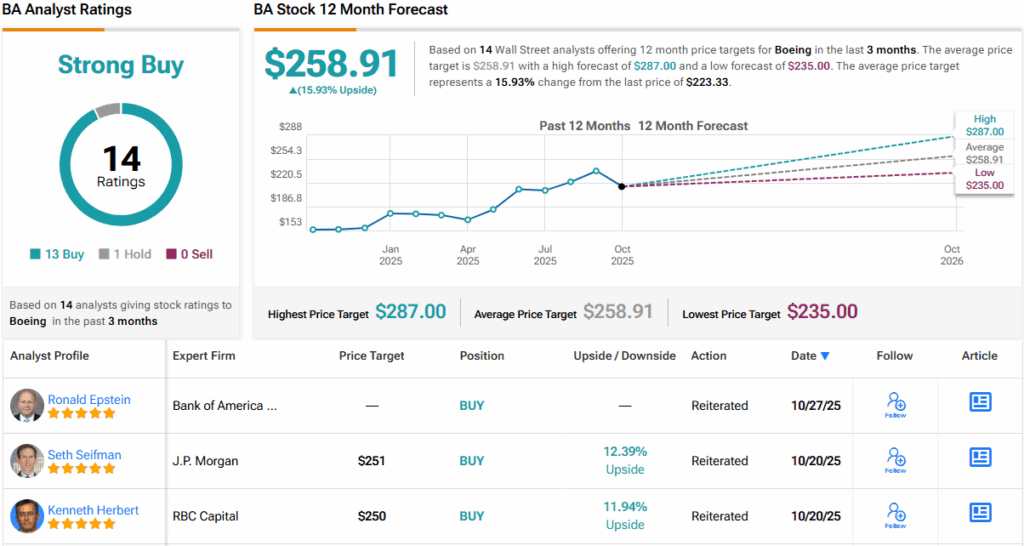

Bottom line, Seifman assigns Boeing shares an Overweight (i.e., Buy) rating, backed by a $251 price target. The implication for investors? Upside of 12% from current levels. (To watch Seifman’s track record, click here)

Almost all analysts agree with that stance; barring one skeptic recommending a Hold, all 12 other BA reviews are positive, making the consensus view here a Strong Buy. The $258.91 average price target factors in a one-year gain of ~16%. (See Boeing stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.