File this one under “Another Last Thing Boeing Needed Right Now,” as aerospace stock Boeing (BA) finds itself the target of student protests at the University of Washington. While the news was not all bad—it also celebrated a massive sale to Qatar Airways—the news was bad enough to investors that shares slid nearly 1.5% in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Interdisciplinary Engineering Building on the campus of the University of Washington was the site of the protests in question, a particular blow to Boeing since it dropped $10 million to aid in its construction, reports noted. The lawless protests featured reports of masked individuals setting fire to dumpsters and blocking access to streets surrounding the building.

Meanwhile, the protesters demanded the university cut ties to Boeing, due to Boeing’s military contracts and the aid provided to Israel in Gaza. The protesters also demanded the building’s name be changed, named for a “teenage engineering student” who was killed in an airstrike. But nearly 30 people were arrested on charges ranging from trespassing to property destruction to disorderly conduct. Even the university will have a hand in their discipline, with students involved to be referred to the university’s Student Conduct Office along with county prosecutors, reports noted.

Monster Sale in Qatar

Remember how President Trump was set to buy a stopgap plane from Qatar to fill in for Air Force One until Boeing could finally get them put together? That might have been the impetus Qatar Airways needed to sign a purchase order for “…around 100 widebody jets” from Boeing. And, as if that were not good enough news, Qatar Airways left an option in to double that order down the line.

The deal is expected to be formally announced during President Trump’s upcoming Middle East trip starting next week, which features a stop in Qatar, among other places. Reports note that Qatar Airways is enjoying something of a renaissance in travel, as its Doha hub is experiencing phenomenal traffic.

Is Boeing a Good Stock to Buy Right Now?

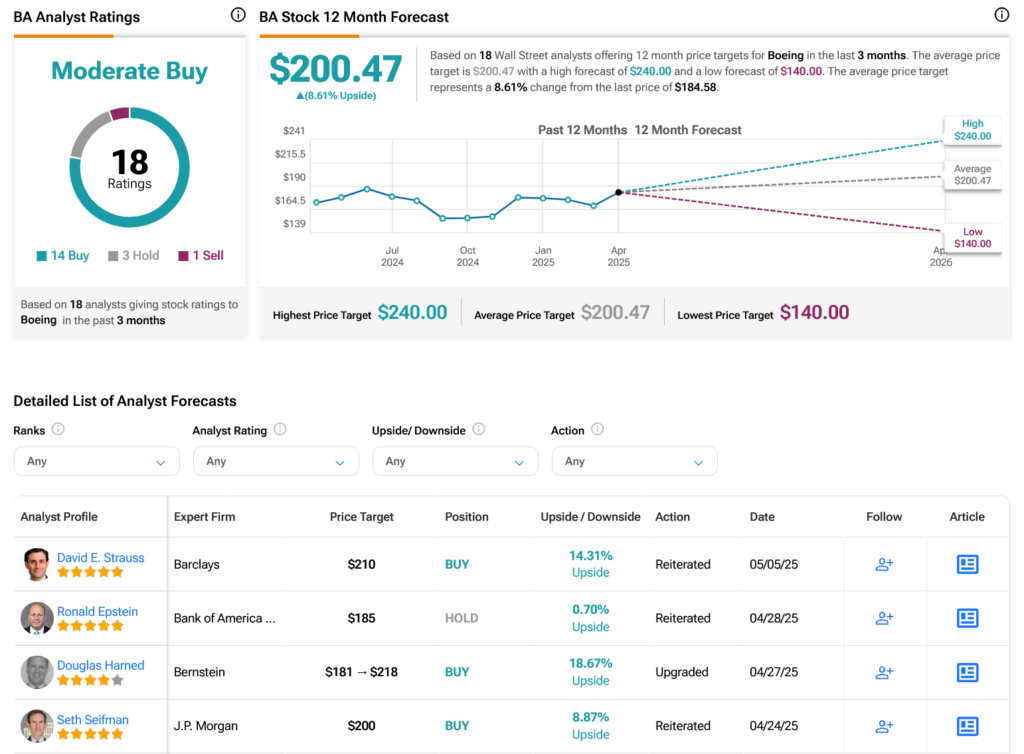

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 14 Buys, three Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 3.96% rally in its share price over the past year, the average BA price target of $200.47 per share implies 8.61% upside potential.