Aerospace stock Boeing (BA) did not have a good day today, and most of the factors that would have caused a bad day have already emerged. That would suggest these points are baked in, but investors were apparently still down on Boeing. We did find out just how long a Boeing plane lasts when it rolls off the line, though, and this—coupled with the entirety of Boeing news of late—was apparently enough to send Boeing shares plunging around 4.5% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

As it turns out, how long a Boeing aircraft actually lasts once it starts making trips can vary, and quite a bit, from one plane to another. It depends on a range of factors, including overall flight hours and “flight cycles,” which generally count as a take-off and landing.

Thus, typically, a Boeing aircraft can be expected to last between 20 and 30 years. Once a Boeing aircraft reaches its end-of-life, it generally does not get scrapped or parted out; rather, it is often sold to a “secondary carrier,” or used for cargo transport. More specifically, narrowbody aircraft like the 737 line will last more around 12 to 15 years, but can actually clear 25 years, assuming proper maintenance and periodic refurbishing.

Holding the Line

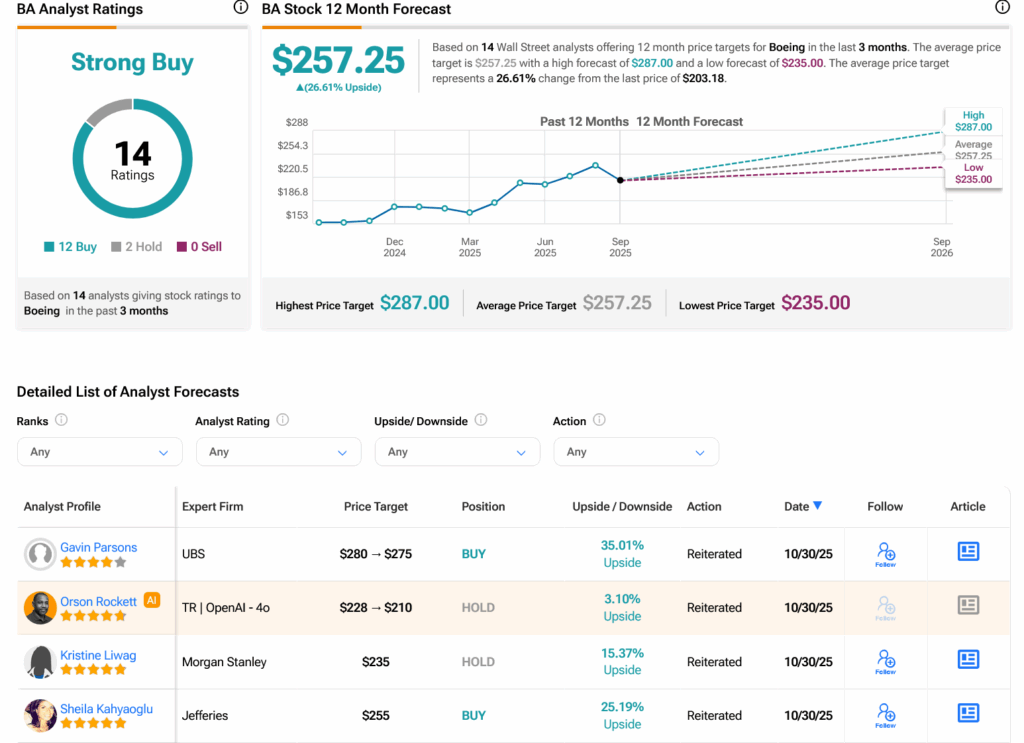

Boeing is also proving a welcome development for analysts. Jefferies analyst Sheila Kahyaoglu—who has a five-star rating on TipRanks—kept her Buy rating in place for Boeing, and set a price target of $255 per share.

In the past, Kahyaoglu has looked for tariffs, and the trade deals around them, to build positive momentum for Boeing. However, the recent certification issues around Boeing and its 777X line have also prompted a cut in that momentum, with the first delivery now set for sometime in 2027. So while there are some clear downsides for Boeing, there seems to be sufficient upside in place to make it a Buy.

Is Boeing a Good Stock to Buy Right Now?

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 12 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 43.04% rally in its share price over the past year, the average BA price target of $257.25 per share implies 26.61% upside potential.