Hope for the best, plan for the worst. That’s about what aircraft maker Boeing (NYSE:BA) is doing, though it doesn’t seem to be helping share prices much. Boeing is down just a little after revealing that the supply chain problems that dogged us all through 2022 and into 2023 may well carry on through 2024 as well.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Boeing’s Dave Calhoun, the current CEO, was at the Qatar Economic Forum when he addressed this point, noting that aircraft makers wanted “stability” as their biggest sticking point, but stability wasn’t likely to be a feature for the next while. While Boeing has made a lot of progress in improving its personal supply chain—it all but had to, given what a shambles it was—there’s still some room to go. Plus, Calhoun also noted not to expect any new designs until somewhere in the 2030s; new technologies need time to develop, after all.

Calhoun also had bad news for those hoping aircraft will go greener in the near term. When discussing biofuels for jet aircraft, Calhoun made it clear: they will “…never achieve the price of jet fuel.” Certain SAFs, or Sustainable Aviation Fuels, are coming into play, but they’re often at least double the price of current jet fuels. Certainly, they can improve and get more economical thanks to scaling, but that will take quite some time. Calhoun doubled down, saying: “There are no cheap ways to do SAF – if there were, we would already be doing them.”

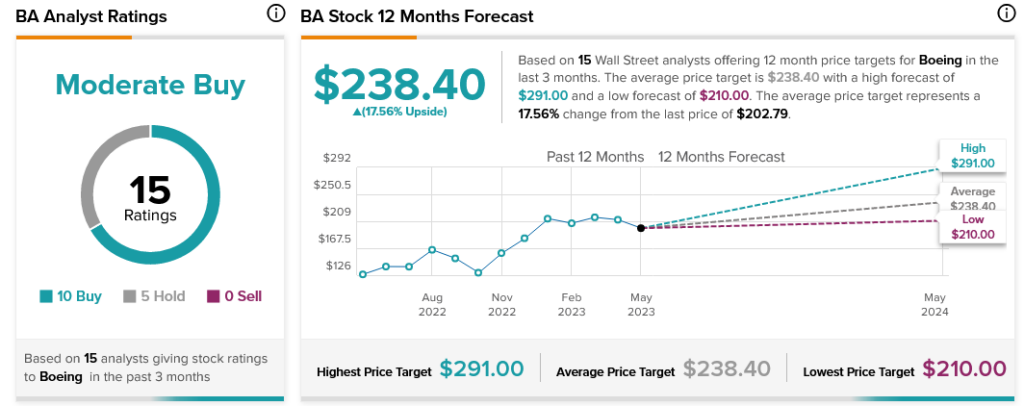

Supply problems or not, Boeing still enjoys analyst support. With 10 Buy ratings and five Holds, Boeing stock is still considered a Moderate Buy. Plus, thanks to its average price target of $238.40, Boeing stock comes with 17.56% upside potential as well.