Boeing (NYSE:BA) appears to be seeing solid demand for its planes. During the recent Paris Air Show, major moves were made by several Indian airlines, signaling a significant surge in India’s demand for both domestic and international travel. Leading the way was startup Akasa Air, who announced the purchase of four additional Boeing 737-8 planes, expanding their growing fleet to 76 jets set to be delivered over the next four years. Vinay Dube, founder and CEO of Akasa Air, expressed enthusiasm about the expansion, marking it as a notable step in the fledgling airline’s journey.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Air Lease, a prominent player in the airline industry, wasn’t far behind with its own announcement at the Paris event. The company is now set to add two Boeing 787 Dreamliners to its fleet. These widebody planes, in the 787-9 configuration, can ferry 296 passengers over a staggering 7,565 nautical miles. Boeing’s 787 model has gained considerable traction recently, garnering over 250 orders and commitments within the last six months.

This comes after Air India, owned by Indian industrial giant Tata, revealed a whopping $70 billion deal for a total of 470 passenger planes split between Airbus and Boeing yesterday. Indeed, 220 of those planes will come from Boeing.

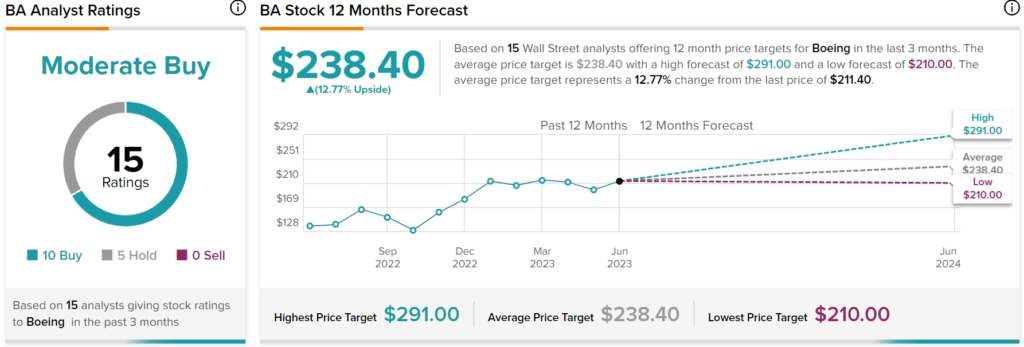

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 10 Buys, five Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $238.40 per share implies 12.77% upside potential.