Things have indeed been looking up for aircraft maker Boeing (NYSE:BA) lately. In fact, they’ve been looking up repeatedly for most of the last week and a half in trading. In fact, shares are up over 2% again today, and Boeing is on track to break a couple new milestones if things go as planned in the last hour of trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In fact, today—if Boeing can hang on to even the barest fraction of the gains made so far today—will mark the seventh straight session in which Boeing shares have improved. That’s good enough news by itself, but it gets better: it’s also on track to break its highs last seen in March 2021, when places were starting to come off of lockdowns and it looked like travel might have a reason to exist again. Boeing has also experienced solid results in aggregate; back in November, Boeing posted gains 17 times, while seeing losses only four.

The Only Constant is Change

Trying to pin down the why of Boeing’s amazing recovery seems to come back to one key point: the Dubai Airshow 2023 event. That event saw huge quantities of Boeing aircraft get sold, and in turn, fired the imaginations of potential investors who wanted to buy in on success. But Boeing is also rapidly changing; it upgraded its sustainability head, Chris Raymond, to the head of its aftermarket business. Raymond will take over for Stephanie Pope, who some suggest is on her way to the CEO slot. Meanwhile, Boeing also reversed its hybrid work policy, insisting on a complete return-to-office despite the clear disapproval of the staff. Already, several Boeing staffers have revealed plans to depart Boeing should the plan go through.

What is the Prediction for Boeing Stock?

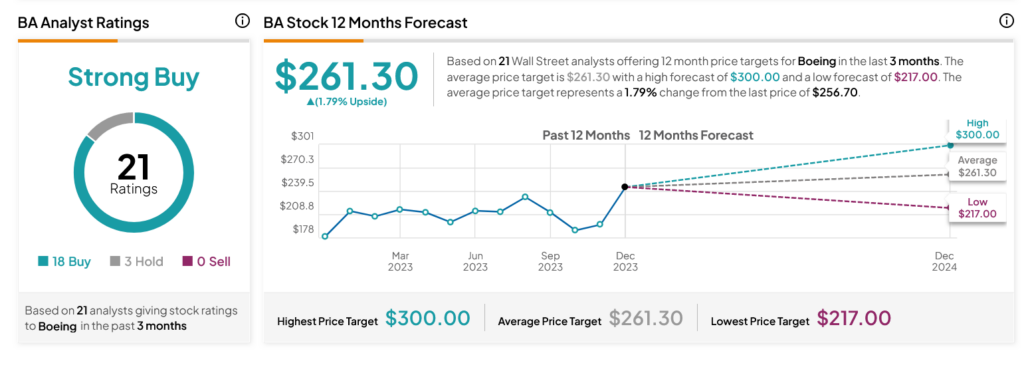

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 18 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 39.69% rally in its share price over the past year, the average BA price target of $261.30 per share implies 1.79% upside potential.