Aircraft maker Boeing (NYSE:BA) did not have a great year as far as its hardware was concerned. But it worked to turn that around, and now, it’s released word that the 737 Max line is finally fixed. That didn’t seem to matter much to investors, though, who dropped Boeing over 1.5% in Thursday morning’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Boeing revealed that a hardware issue on the 737 Max related to the rudder control system has been fixed. Boeing recommends that operators check their rudder control systems for loose components. If found, the fix should be comparatively simple from there, reports suggest, with Boeing recommending the use of tie rods to control rudder movement while compensating for loose components. Meanwhile, that was enough for Boeing to declare that the 737 Max planes can fly safely and that deliveries will carry on as normal.

Improvements Also in Play

Here’s where the news gets much better. While the idea of using tie rods to fix an aircraft’s rudder control might seem like a “spit and baling wire” approach, there are some much more significant improvements on their way as well. For instance, the Federal Aviation Administration (FAA) offered up a supplemental type certificate (STC) for the AerAware enhanced flight vision system (EFVS) on Boeing 737NG aircraft.

That’s going to make flying and landing in low-visibility conditions a lot easier, as the AerAware allows for a “50% reduction in minimum visibility requirements,” an AIN Online report noted. Meanwhile, Boeing also expanded its underwater applications, delivering an Orca extra-large uncrewed undersea vehicle, an XLUUV, to the U.S. Navy.

What is the Prediction for Boeing Stock?

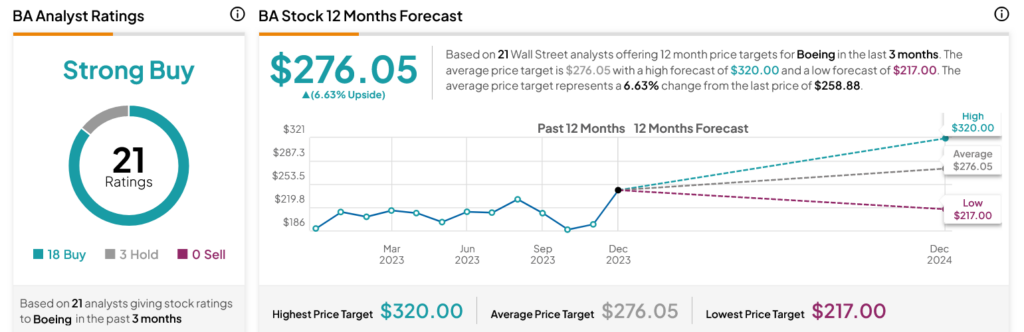

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 18 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 36.89% rally in its share price over the past year, the average BA price target of $276.05 per share implies 6.63% upside potential.