Give aerospace company Boeing (NYSE:BA) some credit here; while it’s kind of down on its luck right now, thanks to a series of mechanical failures that have fundamentally damaged the brand, there are some good signs. In fact, Boeing is currently planning its next major aircraft, and it’s got an absolute doozy of a price tag. Those plans left investors a little skittish, though, as they sent shares down fractionally in Monday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest word from Boeing, via CEO David Calhoun, is that whether or not to even go through with Boeing’s next major airplane design will be left up to his successor. And said successor, whoever that turns out to be, will have quite a decision to make.

Calhoun estimates that the cost of Boeing’s next big aircraft release will be a whopping $50 billion. In fact, reports suggest that no project currently in development at any other aircraft manufacturer even comes close to having a project that costs that kind of dough.

A Surprise Return?

So, what will that new aircraft look like? What features will it include? Well, for right now, Boeing’s playing this one close to the vest. However, one report suggests a good possibility for Boeing to tackle: a revival of the B797. The B797 would be considered a “middle-of-market aircraft,” which would make it a good potential replacement for the 757 and 767 lineup.

That’s not a bad point, especially given that a lot of airline operations are looking to pare back on expenses as costs continue to rise. Offering a solid middle-market entrant should draw plenty of interest, especially if costs stay low and Boeing can meet sales schedules without providing planes where parts randomly reach their destination before the passengers do.

Is Boeing Stock a Buy, Sell, or Hold?

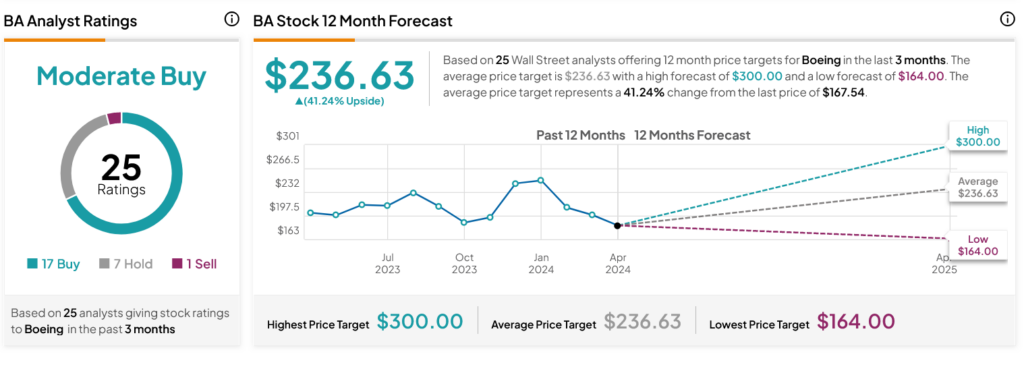

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 17 Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 17.72% loss in its share price over the past year, the average BA price target of $236.63 per share implies 41.24% upside potential.