Investors, sometimes, defy expectations, and today was no different for beleaguered aircraft maker Boeing (NYSE:BA). Boeing revealed today that it was planning to spend a lot more money and not get near so much out of it. The revelation, however, was enough to send Boeing shares up nearly 3% in Wednesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

We all know that Boeing has been having trouble lately with random parts falling off the aircraft. Panels, tires, entire chunks of fuselage…you’ve read the same stories. And you also know that the government has stepped in to put limits on just how many aircraft Boeing can make in a month. But that kind of deliberate progress comes at a cost, which Boeing clarified somewhat: its cash burn rate was going to increase.

In fact, Boeing pushed back an earlier goal regarding the company’s cash flow as a result of the new policies. As the company’s chief financial officer, Brian West, described it, “We’re deliberately going to slow to get this right.”

Boeing Is Trying to Appease Regulators

Those of a more cynical bent will likely point out that Boeing isn’t deliberately going slow just to “get this right” so much as it is going slow to appease regulators. But “get(ting) this right” will certainly be part of the outcome. The head of the Federal Aviation Administration (FAA), Michael Whitaker, has already noted that Boeing has “…put production ahead of safety,” which is clearly about to change with its deliberate slowdown.

Of course, this also puts Boeing at risk, particularly as the few competitors there are ramp up their own productions in a bid to take market share out from under the deliberately hobbled Boeing. However, a Boeing with a renewed reputation for quality certainly can’t hurt its sales.

What Is the Prediction for Boeing Stock?

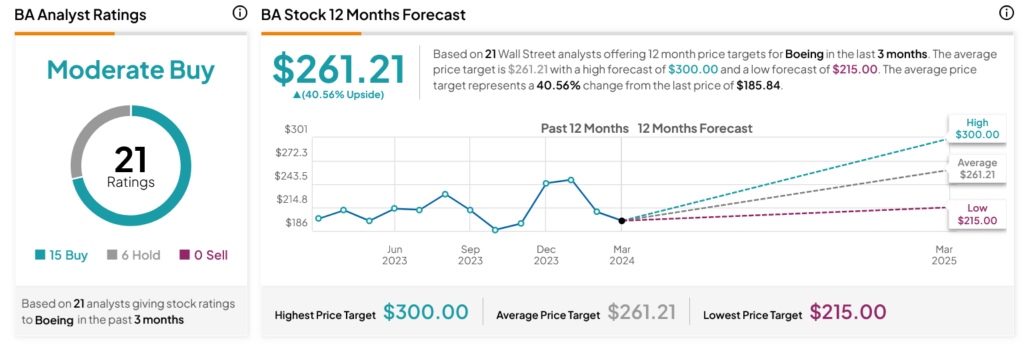

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BA stock based on 15 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 9.16% loss in its share price over the past year, the average BA price target of $261.21 per share implies 40.56% upside potential.