First published: 2:20 AM EST

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Shares of Boeing (NYSE:BA) are tanking in early trading, as the company hit a pause on the deliveries of certain 737 Max jets due to problems related to a part supplied by Spirit AeroSystems (NYSE:SPR). Shares of SPR are getting hammered as well.

The aircraft maker expects the issue to impact a “significant” number of the 737 MAX 7, 737 MAX 8, and MAX 8-200 jets, as well as the P-8 Poseidon maritime surveillance aircraft that are based on the 737. Further, it warned of lower near-term deliveries. Boeing shares fell 5.2% in Thursday’s after-hours trading, while Spirit shares were down 11.5%.

The supplier notified Boeing about a “non-standard” manufacturing process used on two fittings in aft fuselages. While Boeing did not mention the supplier name, CNBC first reported the supplier as Spirit.

“Spirit is working to develop an inspection and repair for the affected fuselages. We continue to coordinate closely with our customer to resolve this matter and minimize impacts while maintaining our focus on safety,” said the supplier in a statement.

Boeing has notified the Federal Aviation Administration (FAA) of the issues and said that the matter, which could date back to 2019, was not “an immediate safety of flight issue and the in-service fleet can continue operating safely.” The FAA “validated” Boeing’s assessment about there being no immediate safety issues based on the data provided by the company. Nonetheless, FAA will check all affected aircraft prior to delivery.

Boeing’s Persistent Problems

The latest production woes for Boeing come at a time when the company is trying to ramp up its deliveries and improve its financial performance. On Tuesday, Boeing reported 130 deliveries for the first quarter, reflecting a year-over-year increase of 27%. The company delivered 64 aircraft in March, including 52 737 Max. Boeing is taking efforts to recover from the COVID-induced slump and two fatal crashes that massively impacted its credibility.

The impact of the latest issue related to 737 Max could impact key airlines, which are already facing aircraft shortage.

“We’re aware of the issue and working with Boeing to understand how it may impact our MAX deliveries,” said an American Airlines (NASDAQ:AAL) spokesperson.

Following discussions with Boeing, United Airlines (NASDAQ:UAL) said that it currently does not expect any significant impact to its planned capacity for the summer or the rest of the year.

Is Boeing a Buy, Sell, or Hold?

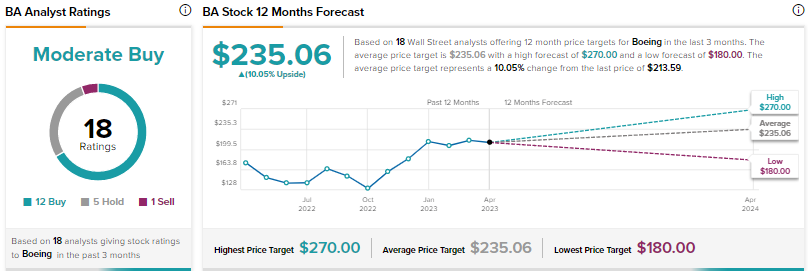

Wall Street is cautiously optimistic about Boeing, with a Moderate Buy consensus rating based on 12 Buys, five Holds, and one Sell. The average price target of $235.06 suggests 10% upside. Shares have risen 12% since the start of this year.