The fight between aerospace stock Boeing (BA) and the International Association of Machinists and Aerospace Workers (IAM) union is heating up. While Boeing’s strategy seems to be to wait the IAM out, the IAM is fighting back with strong allegations. The latest? That Boeing is “spreading lies” about the latest proposal from the union. Investors, though, seem less concerned. Boeing shares were up nearly 1.5% in Tuesday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The part that the IAM seemed to take particular exception to was the idea that the union’s pre-ratified proposal to Boeing was “not real.” And in a certain sense, this is incorrect. The proposal is real, it does exist, and it has been sent to Boeing. Of course, Boeing seemed to mean “not real” here in the sense that it does not particularly matter as Boeing will not consider it anyway.

But the IAM shot back anyway, declaring, “To call our members’ ratified proposal ‘not real’ is disrespectful to every worker who has stood on the line, kept production moving, and made this company what it is. Boeing cannot wish it away with a press release filled with lies. It’s time the company stopped playing games with the livelihoods of the very people who make its success possible and come back to the table in good faith.”

Another Huge Win in Turkey

Boeing will be needing those workers back to work soon, if it wants any hope of filling the orders that continue to flood in as President Trump continues building trade deals, which mean huge sales for Boeing. Though admittedly, the St. Louis workers will not be working much on the commercial airliners that Boeing is about to sell in Turkey.

Reports noted that Turkey is planning to buy “…hundreds of Boeing airliners…” The interesting part is that this move comes after Turkey, back in 2019, ran afoul of the first Trump administration by buying S-400 missile defense systems from Russia. This left the United States shutting down an F-35 jet sale, and pulling Ankara from joint production operations.

Is Boeing a Good Stock to Buy Right Now?

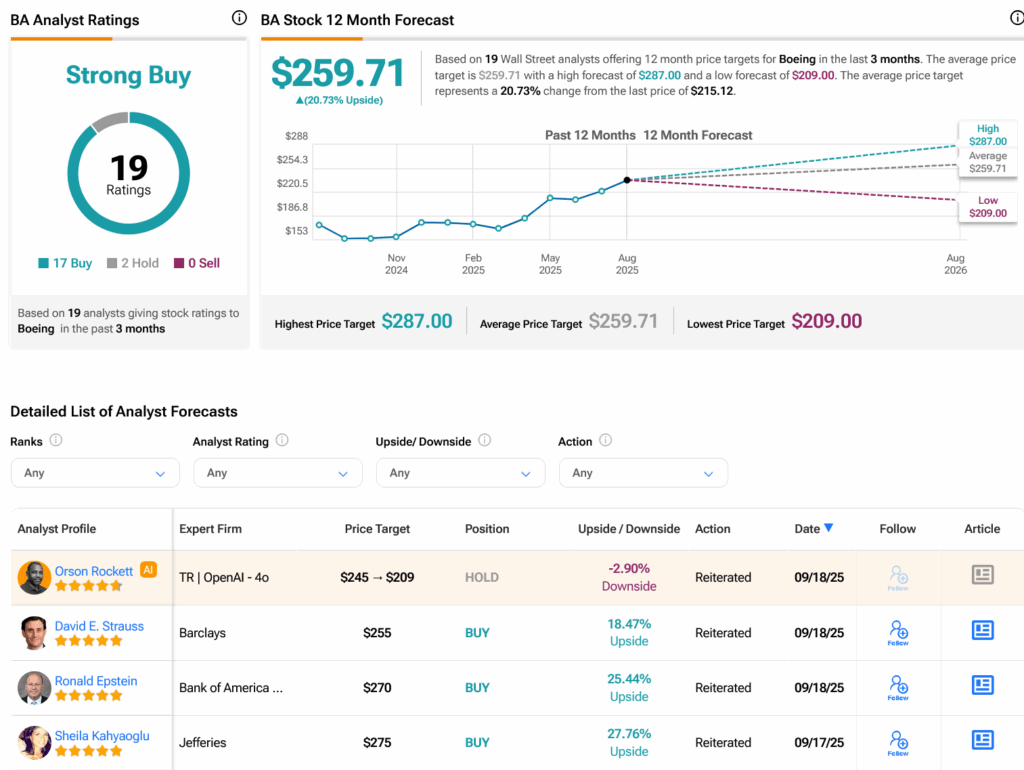

Turning to Wall Street, analysts have a Strong Buy consensus rating on BA stock based on 17 Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 36.12% rally in its share price over the past year, the average BA price target of $259.71 per share implies 20.73% upside potential.