Shares of Boeing plunged 6.8% on Tuesday after the airplane manufacturer lowered its long-term forecast for commercial aircraft demand citing continued significant challenges due to the COVID-19 pandemic.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Boeing (BA) now predicts global airlines would need 18,350 commercial airplanes valued at about $2.9 trillion over the next decade, an 11% reduction from its 2019 projections. The company also forecasts that the total market value for aerospace products and services demand over the next 10 years would decline to $8.5 trillion from the $8.7 trillion expected last year.

Boeing said that “Airlines globally have begun to recover from a greater than 90% decline in passenger traffic and revenue early this year, but a full recovery will take years.” (See BA stock analysis on TipRanks)

In addition, the aerospace giant trimmed its rolling 20-year forecast for commercial aircraft demand. The company projects a delivery of 43,110 commercial airplanes globally over the next two decades, down 2% from its 2019 estimates of 44,040 aircraft.

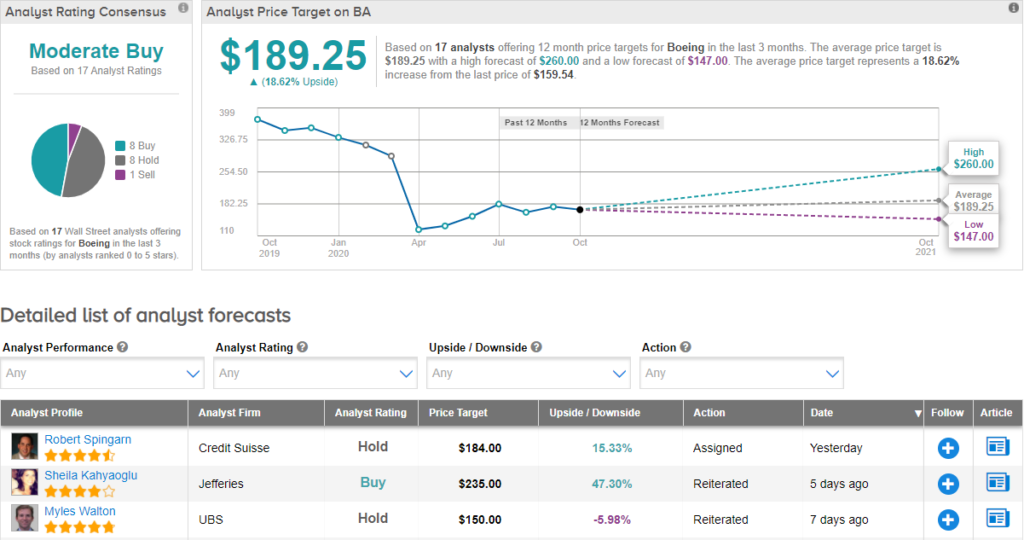

On Oct. 6, Credit Suisse analyst Robert Spingarn raised the stock’s price target to $184 (15.3% upside potential) from $154 saying that “there could be some near-term opportunity for shares given the catalyst path (MAX ungrounding, potential vaccine/therapeutic progress).”

However, Spingarn reiterated a Hold rating citing multiple downside risks including “increased financial leverage, proven fragility, an increased likelihood of future development issues (due to mass layoffs—the same occurred on 787 post 9/11 layoffs), and increased uncertainty regarding the company’s terminal value.”

Currently, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 8 Buys, 8 Holds and 1 Sell. With shares down nearly 49% year-to-date, the average price target of $189.25 implies upside potential of about 18.6% to current levels.

Related News:

Boeing Wins $298M US Contract For Satellite System

Alaska Airlines To Offer Hawaii-Bound Travelers Covid-19 Tests

Southwest Urges Workers To Take Pay Cuts To Avoid Layoffs