Shares of aerospace and defense major Boeing (NYSE:BA) are sliding today after the company delivered a disappointing fourth-quarter performance. Revenue rose 35.1% year-over-year to $19.98 billion but fell short of estimates by $120 million.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Net loss per share at $1.75 was on the opposite end of the spectrum as compared to analysts’ expectations of a net income per share of $0.20. During this period, Boeing saw its order backlog balloon to $404 billion and delivered 152 planes. Additionally, free cash flow generation came in at $2.3 billion for the year.

Looking ahead to 2023, the company now expects free cash flow generation to hover between $3 billion and $5 billion.

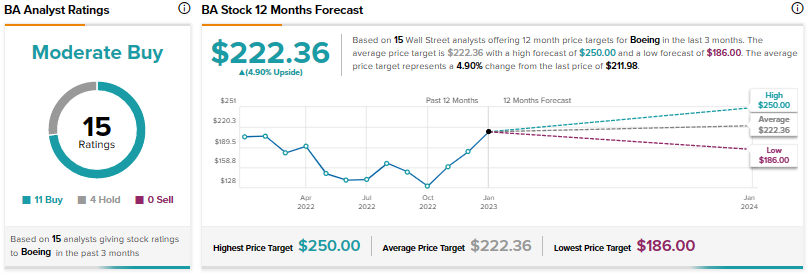

Overall, Wall Street has a consensus price target of $222.36 on BA, implying a 4.90% upside potential, as indicated by the graphic above. Shares of the company have already run up about 35% over the last six months.

Read full Disclosure