Blue Bird Corp. (NASDAQ:BLBD), a manufacturer of electric and low-emission school buses, jumped in pre-market trading after it announced adjusted earnings of $0.66 per share in the fourth quarter compared to a loss of $0.66 per share in the same period last year. Analysts were expecting the firm to report earnings of $0.48 per share.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Blue Bird generated revenues of $302.9 million in the fourth quarter, up 17.6% year-over-year and above consensus estimates of $290.1 million.

Due to these strong results, the company raised its FY24 forecast. Razvan Radulescu, CFO of Blue Bird Corp. commented, “With the strong finish to 2023 and better line-of-sight into 2024, we are raising our fiscal 2024 guidance to Net Revenue to $1.15-$1.25 Billion, Adj. EBITDA of $105-125 million and Adj. Free Cash Flow of $50-60 million.”

In addition, Blue Bird re-affirmed its long-term outlook. In fact, it expects to generate around $2 billion in revenues with an adjusted EBITDA margin of more than 12%.

Is BLBD a Good Stock to Buy?

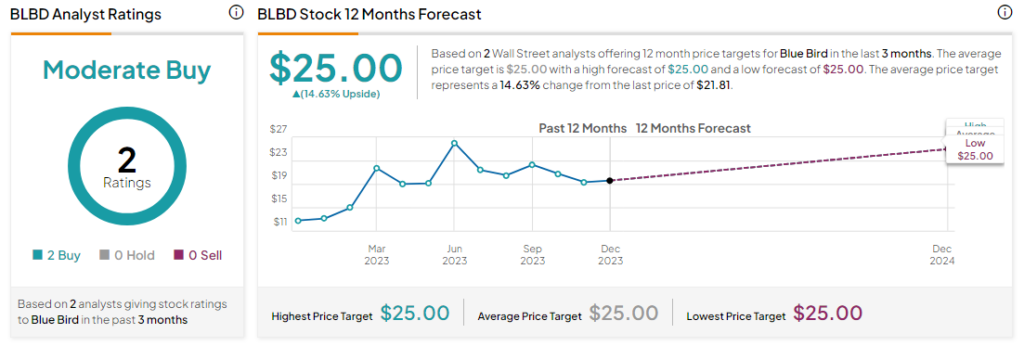

Analysts remain cautiously optimistic about BLBD stock with a Moderate Buy consensus rating based on two Buys. Year-to-date, BLBD stock has surged by more than 80%, and the average BLBD price target of $25 implies an upside potential of 14.6% at current levels.