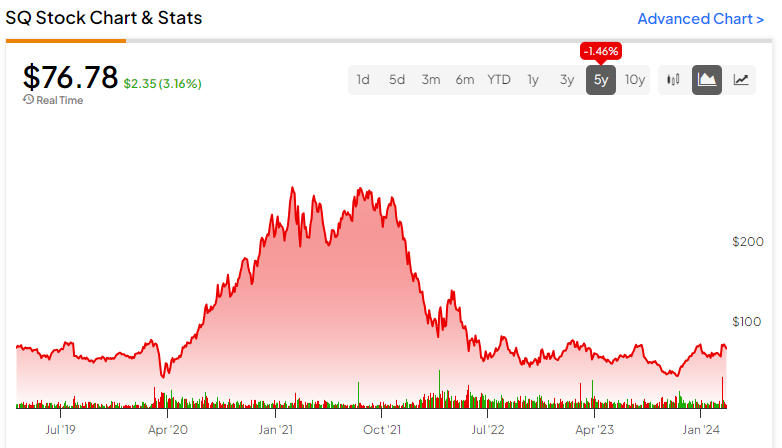

Shares of Block (NYSE:SQ), the fintech firm behind the popular Cash App, have been picking up traction lately, thanks in part to upbeat guidance following the release of its mixed fourth quarter results. The stock has now doubled from its low hit back in October and may be in a good spot to win back the hearts (and investment dollars) of growth investors. Though the recent doubling is a big deal, Block stock remains 73% off its 2021 peak, leaving plenty of room to run as rates fall.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

I’m a big fan of founder-led firms and an even bigger fan of Jack Dorsey. As Dorsey and his team look to strengthen its big two (Cash App and Square), I see a pathway higher and am inclined to stay bullish on the stock, just like the many Wall Street analysts who hiked their price targets and positions after the company’s brighter 2024 outlook.

Also, I’d not be too surprised if Block starts garnering the enthusiasm that investors and analysts once had during the glory days of 2021. As a stock that’s nowhere close to hitting new highs, Block stands out as more of a “GARPy” (growth at a reasonable price) play in a market that’s starting to develop a bit of froth following the recent AI-driven surge.

Block’s Guiding Higher to Kick Off 2024. Could This be a Turning Point?

Block seems to be inching closer toward greater profitability, with its recent guidance update calling for a gross profit of $8.65 billion for 2024, slightly above the consensus of $8.55 billion. EBITDA is also slated to come in at $2.65 billion, more than 10% higher than expected.

Undoubtedly, investors seemed to be pounding the table following the hikes that weren’t too ground-breaking. In any case, given how low expectations were going into the number, it seems like investors are hanging onto any sort of good news they can get with Block stock.

Looking ahead, a strengthening economy alone may be enough to power Block stock’s comeback. Add Block’s efforts to keep costs under control into the equation, and I think it’s tough to be a profit-taker after Block stock’s latest run and upbeat expectations for its coming first quarter of 2024.

Looking under the hood, the fourth quarter numbers were nothing to write home about. Technically, the company had a mixed bag of results, falling short on earnings per share ($0.45 vs. the $0.58 analyst expectations) on $5.8 billion in revenue (a slight top-line beat).

Still, there were positive points aside from the upbeat management guide. Cash App saw its sales surge 31% to $3.91 billion, ahead of analysts’ estimates of $3.71 billion — a positive surprise of over 5%. Square and Afterpay were also buoyed by a robust sales season (Black Friday and Cyber Monday).

Block’s Three Top Drivers Seem to be Faring Better, Despite Hungry Rivals

Block’s three drivers (Cash App, Square, and Afterpay) seem to be returning to the right track. And they could march higher over time as Jack Dorsey focuses on bolstering growth while keeping costs in check. In a higher-rate environment, firms like Block must prove that they can sustain themselves. Thus far, I’d say Block has done a pretty good job of adapting to the higher-rate environment, at least a better job than the long-term stock chart suggests.

I found the recent resilience in Square to be quite remarkable. The segment is not doing bad for an ecosystem that was thought to be at risk of being bettered by a growing number of rivals in the point-of-sales (PoS) scene. Perhaps many of the bears underestimated just how sticky the Square ecosystem was for various merchants.

As firms like Apple (NASDAQ:AAPL) look to grab a larger slice of the fintech services (think PoS) scene, Square will need to find ways to stay ahead of the pack. For now, it looks like Square will be able to fend off the initial rush of competitors as it looks for ways to keep its merchants locked in.

Sure, Apple Tap to Pay looks like a potentially disruptive service to platforms like Square. But really, what’s causing merchants to jump ship over to Apple’s ecosystem? Until now, there’s not a whole lot of incentive to switch PoS providers, especially for those merchants who already have all the infrastructure in place, not to mention the training to use Square’s service.

Of course, Square needs to stay on its toes to fend off competition. For now, Dorsey may have the upper hand as he looks to generative AI to help fortify the Square ecosystem. As long as Square continues harnessing AI’s power, it’ll stay ahead of the pack and make it tougher for disruptors to crack its share of the payments market.

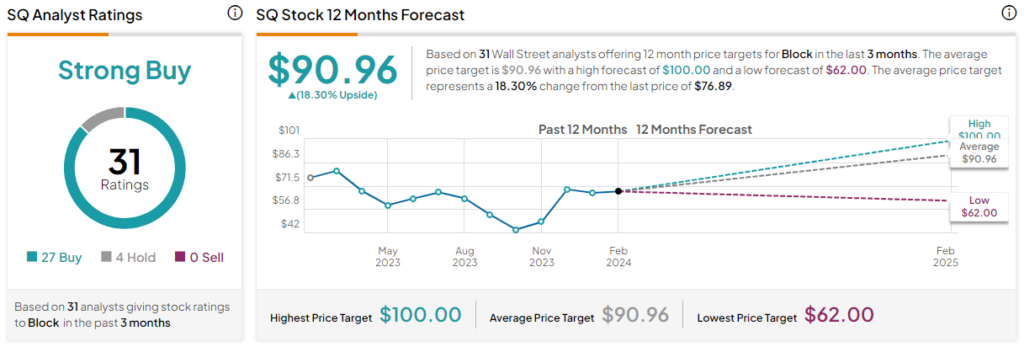

Is SQ Stock a Buy, According to Analysts?

On TipRanks, SQ stock comes in as a Strong Buy. Out of 31 analyst ratings, there are 27 Buys and four Hold recommendations. The average SQ stock price target is $90.96, implying upside potential of 18.3%. Analyst price targets range from a low of $62.00 per share to a high of $100.00 per share.

The Bottom Line on SQ Stock

Block’s latest upbeat guidance for the start of 2024 is more than encouraging. As Jack Dorsey embraces new technologies (generative AI) to add to the stickiness of Square, Cash App, and even Afterpay, it’s likely a mistake to count the firm out of the game as it looks to proceed with its comeback.