Blackstone (BX) stock was down on Thursday following news that the company is considering strategic options for Ancestry.com. According to a Reuters report, the investment firm is considering an initial public offering (IPO) or sale of Ancestry.com.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Insiders claim that an IPO for Ancestry.com could be valued at $10 billion. For comparison, Blackstone bought the company for $4.7 billion in 2020 from a collection of private investment firms. An IPO would return Ancestry.com to the public market after 13 years under the ownership of various investment firms. The sale option would include Ancestry.com’s assets, though it’s still unclear exactly what this would mean or how much Blackstone would expect to get from such a deal.

Blackstone is incentivized to hold an IPO for Ancestry.com due to changing market conditions in the U.S. While the IPO market has been slow, largely due to high interest rates, the Federal Reserve has finally started cutting those rates again. Interest rates were slashed by a quarter point last week, but Chairman Jerome Powell has warned that further cuts might not happen due to inflation, which has remained above the Federal Reserve’s target since 2021.

Blackstone Stock Movement Today

Blackstone stock was down 0.75% in pre-market trading on Thursday, following a 3.69% drop yesterday. The shares have rallied 5.54% year-to-date and 16.04% over the past 12 months. Blackstone has achieved gains in 2025 despite ongoing economic issues, such as inflation, the trade war, and tariffs.

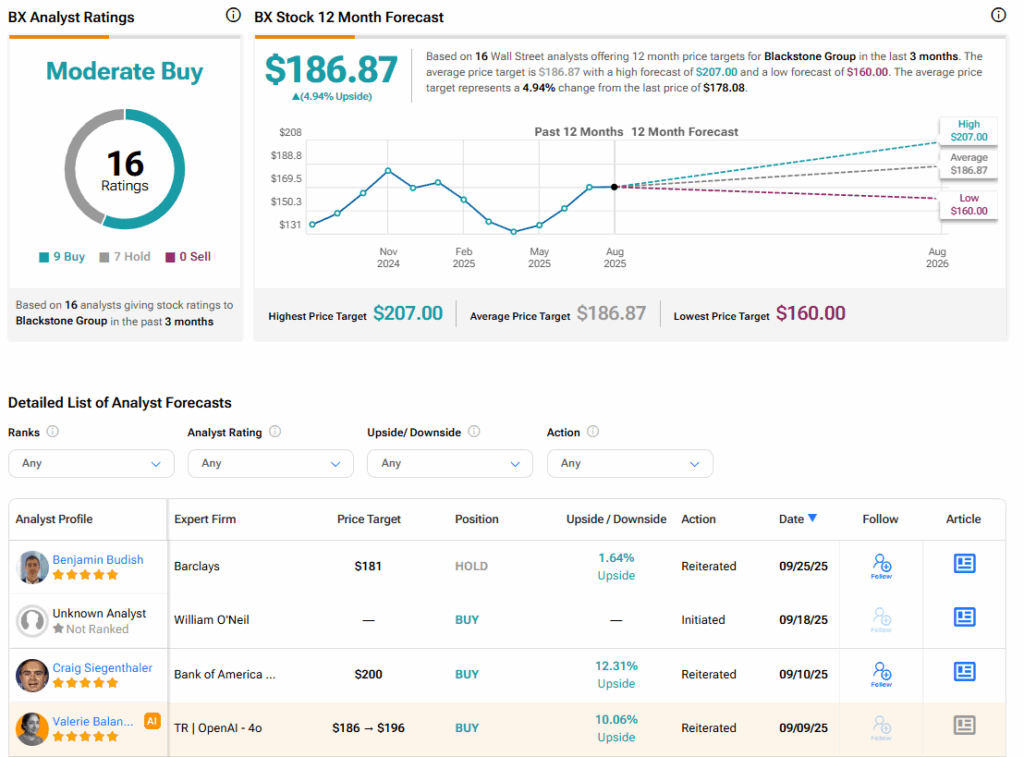

Is Blackstone Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Blackstone is Moderate Buy, based on nine Buy and seven Hold ratings over the past three months. With that comes an average BX stock price target of $186.87, representing a potential 4.94% upside for the shares.