Leading alternative asset manager Blackstone (NYSE:BX) has emerged as the top contender to win a substantial $17 billion portfolio of commercial property loans. This portfolio is part of the FDIC’s (Federal Deposit Insurance Corporation) sale of debt associated with the now-defunct Signature Bank, as reported by Bloomberg.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Following the regulatory seizure of Signature Bank in March, the FDIC has been actively marketing its loans, backed by retail, office, industrial, and apartment buildings. According to the report, FDIC officials are currently in the final stage of discussion to officially designate Blackstone’s bid as the successful one. It is interesting to note that Blackstone may partner with Rialto Capital, a move that will enable the asset manager to service some of the loans.

It’s important to note that Signature Bank’s commercial-property loan portfolio is attractive because of its substantial focus on rent-stabilized properties used as collateral, Matt Pestronk, president and co-founder of Post Brothers, told Reuters in September. Although Blackstone is currently leading as the preferred candidate to acquire this appealing loan portfolio, there remains the possibility of another bidder prevailing or the loan pool being distributed among various interested parties.

Meanwhile, let’s look at what the Street recommends for Blackstone stock.

What is the Forecast for Blackstone Stock?

Blackstone’s large-scale and distinct investment strategies position it well to capitalize on future growth opportunities. However, the challenging macro environment keeps analysts cautiously optimistic about its prospects.

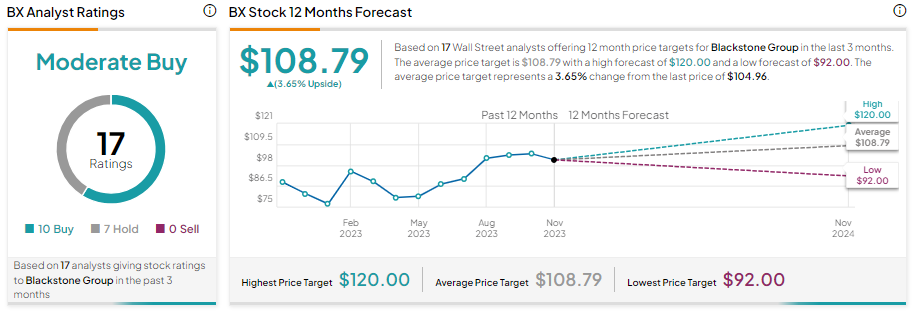

With 10 Buy and seven Hold, Blackstone stock has a Moderate Buy consensus rating. Further, analysts’ average price target of $108.79, implies a limited upside potential of 3.65% from current levels.