BlackRock (NYSE:BLK), the world’s largest asset manager, will now remove companies violating certain environmental, social, and governance (ESG)-related standards from some of its iShares exchange-traded funds (ETFs) in at most 45 days. This marks a 50% reduction compared to the previous time limit of 90 days, Reuters reported.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BlackRock’s “fast-exit” rule is applicable to 35 of its Europe-listed ESG ETFs that track MSCI custom indices. These rules were introduced to BlackRock’s MSCI custom indices beginning December 1, 2022. Companies will be reviewed on a monthly basis for exclusion from the ETFs for breaches of ESG standards.

A BlackRock spokesperson told Reuters that the change in rule followed conversations with German wealth managers who were inclined to see faster removal of companies with poor ESG performance across ETFs. “We found that there was a desire to re-examine the timescales around the removal of companies with the worst controversies,” said the spokesperson.

The removal of a company from the ETFs will be triggered if its MSCI ESG Controversies score drops to zero, on a scale of 0-9, or if MSCI decides that it is in violation of the United Nations Global Compact (an initiative urging businesses to adopt sustainable and socially responsible policies) and removes it from the index. The MSCI ESG Controversies reviews companies based on actual or alleged involvement across several ESG indicators like human rights, child labor, and toxic waste.

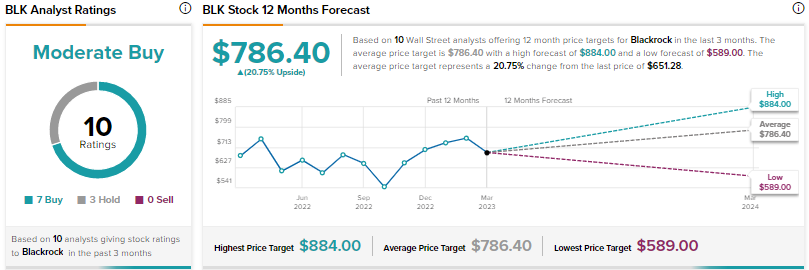

Is BlackRock a Buy, Sell, or Hold?

Wall Street has a Moderate Buy rating for BlackRock based on seven Buys and three Holds. The average BLK stock price target of $786.40 suggests nearly 21% upside potential.