Shares of financial technology and services provider Blackrock (NYSE:BLK) are trending higher today after the company posted better-than-expected first-quarter numbers on the bottom line front.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Revenue declined 9.8% year-over-year to $4.24 billion but was largely in line. EPS at $7.93, on the other hand, surpassed expectations by $0.15. During the quarter, long-term net inflows rose by 5% to $103 billion.

Nonetheless, the company’s average AUM and performance fees have seen an impact from lower markets and dollar appreciation. Further, its operating income also saw an 18% decline as compared to the year-ago period.

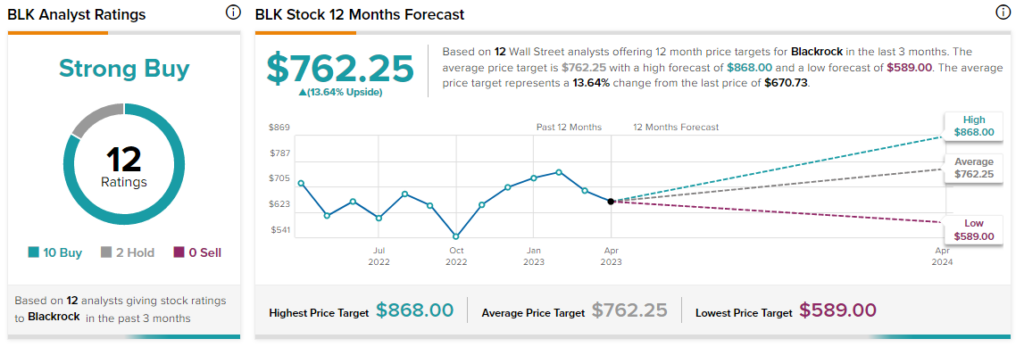

Overall, the Street has a $762.25 consensus price target on BLK, pointing to a 13.6% potential upside in the stock. That’s after a nearly 5% gain in BLK shares over the past month.

Read full Disclosure