Canadian technology company and meme stock Blackberry (TSE: BB) (NYSE:BB) reported its Fiscal Q3-2023 financial results today, and both revenue and earnings beat analysts’ estimates. Note: all figures are in U.S. dollars unless otherwise stated.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Blackberry’s revenue reached approximately $169 million compared to the consensus estimate of about $167.3 million, representing an ~8% decrease. 62.7% of its revenue came from Cybersecurity, 30.2% came from its Internet of Things (IoT) segment, and the rest came from Licensing & Other. Also, its adjusted net loss per share was $0.05, worse than the $0.00 per share achieved in the same period last year but better than the $0.08 loss that analysts were expecting.

Adjusted EBITDA was negative as well, at -$22 million compared to -$8 million last year.

Positively, Blackberry’s gross margin came in at 64.5% compared to 63.6% in the prior-year period. This is likely due to the 19% growth in IoT revenue, which carries an 80% gross margin. If BB can keep growing this segment, its profitability can improve. Blackberry ended the quarter with $449 million in cash and equivalents, along with $392 million in debt.

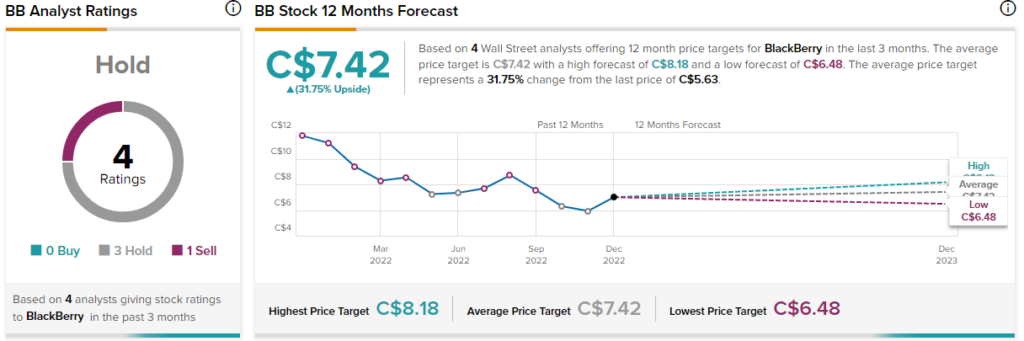

Is Blackberry Stock a Buy, According to Analysts?

Turning to Wall Street, BB stock comes in as a Hold based on zero Buys, three Holds, and one Sell assigned in the past three months. The average BB stock price target of C$7.42 implies 31.75% upside potential, nonetheless.

The Takeaway

Blackberry’s results were decent but not perfect. While the company beat expectations and its gross profitability improved, its net loss widened, and total revenue fell year-over-year. Guidance was not provided in the press release and will instead be provided in the company conference call. As of right now, the stock is mostly unchanged in the after-hours session, but things can change if a poor outlook is issued.