Technology major BlackBerry (TSE:BB) (NYSE:BB) has scrapped plans to list its IoT business as a public company. Instead, the firm’s IoT and Cybersecurity units will function as fully standalone businesses.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In October, BlackBerry announced plans to spin off its Cybersecurity and IoT businesses into two independently operated entities. At the time, the company had aimed for an initial public offering of its IoT unit, with a target launch in the first half of the next fiscal year.

Dick Lynch, Board Chair at BlackBerry, commented, “The Board, with input from its advisors, believes that a full separation of BlackBerry’s IoT and Cybersecurity businesses will open up a number of strategic alternatives that can unlock shareholder value.”

Additionally, the company has brought in a new CEO, John Giamatteo, with immediate effect. Giamatteo served as the President of BlackBerry’s Cybersecurity business for nearly two years. Richard Lynch, the company’s Interim CEO, will continue to serve as its Board Chair.

BlackBerry is slated to report its third-quarter results on December 20. Analysts expect the company to incur a net loss per share of $0.04 on revenue of $166.28 million for the quarter. In the comparable year-ago quarter, BB’s EPS of -$0.05 had come in narrower than the Street’s expectations by $0.03.

What is the Future Prediction for BB Stock?

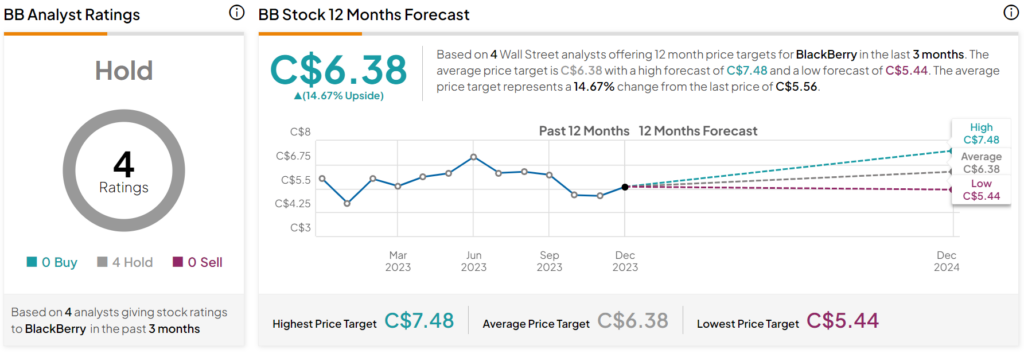

Overall, the Street has a Hold consensus rating on BlackBerry. After a nearly 16% rise in its share price over the past month, the average BB price target of C$6.38 implies a further 14.7% potential upside in the stock.

Read full Disclosure