Shares of security software and services provider BlackBerry (NYSE:BB) are trending lower in the pre-market session today after the company announced preliminary fourth-quarter numbers.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

BB’s fourth quarter was marked by macro challenges in its cybersecurity unit and longer sales cycles in government deals. For Q4, the company now expects revenue at $151 million. This includes IoT revenue of $53 million and cybersecurity revenue of $88 million.

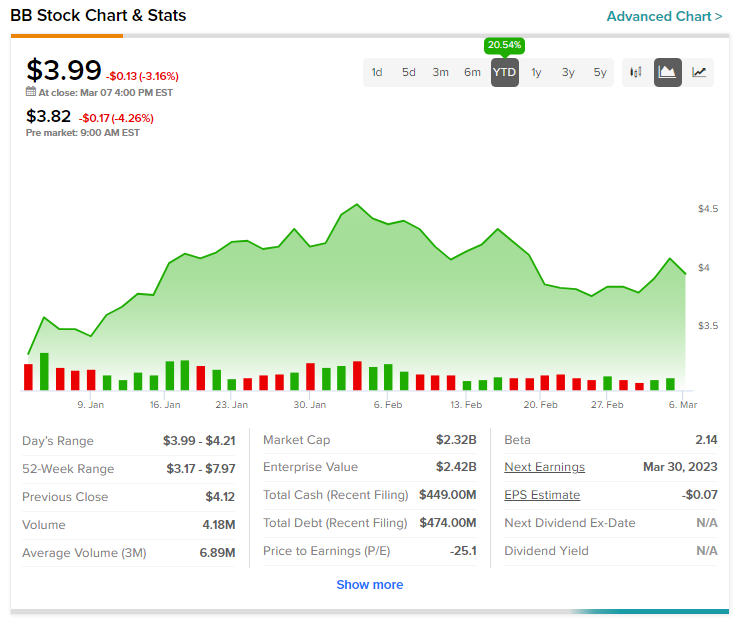

Further, cybersecurity billings are anticipated at $107 million, clocking a third sequential quarterly gain. The company is expected to provide guidance for fiscal 2024 on its earnings call on March 30. The Street expects BB to incur a net loss per share of $0.07 for Q4.

Overall, Wall Street has a consensus price target of $5 on BB, implying a 25.3% potential upside in the stock. That’s on top of a 20.5% gain in the share price so far in 2023.

Read full Disclosure