Letting artificial intelligence plan your vacation sounds like a great start to a horror movie. Possibly one scripted by artificial intelligence. But that’s just what’s going on with Booking Holdings (NASDAQ:BKNG) who recently opened up Pandora’s Box of AI and added it to their Booking.com apps. That was good enough for investors, who gave the share price a nice upward tick in Tuesday’s trading, letting it close up 3.23%.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Dubbed the AI Trip Planner, the release—currently in beta—will take the panoply of options that are available to travelers and help them narrow down said options based on a slate of questions. Users can ask the platform to search for certain destinations or certain qualities that some destinations may have. This even includes some destinations that users may never have heard of, to begin with. Users can get as specific as one single city or expand outward to countries and even regions to produce their ideal vacation. A Barron’s report even notes that the AI can do such searches and even can present “less touristy” options first, as well as presenting complete itineraries.

Booking Holdings CEO Glenn Fogel noted that generative AI is little more than the natural progression of Booking Holdings operations. Fogel further noted that Booking.com has been doing things manually that AI would be particularly suited for, like deciding which order to present hotel photos or presenting the most relevant customer reviews right away.

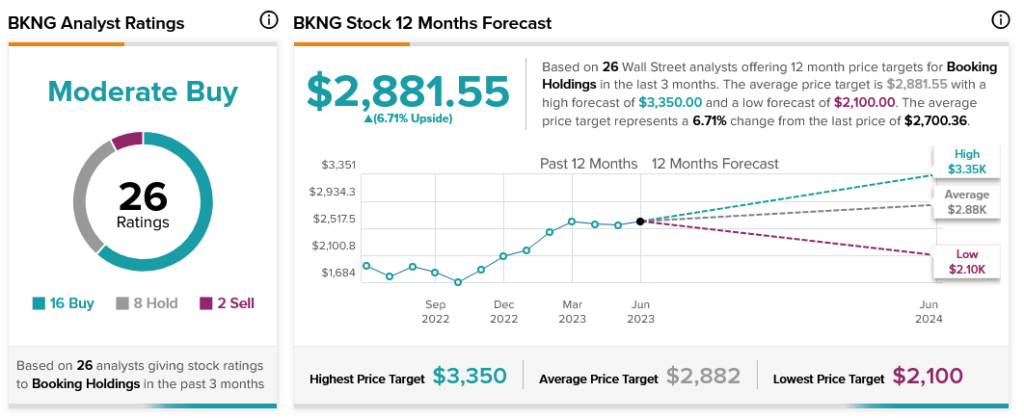

Booking Holdings stock got a healthy boost today, and analysts are generally in favor themselves. Booking Holdings is considered a Moderate Buy, thanks to 16 Buy ratings, eight Holds, and two Sells. With an average price target of $2,882, however, Booking Holdings stock can only boast a modest 6.71% upside potential.