Bitcoin might just be gearing up for another big surge. Data from the onchain analytics firm CryptoQuant has caught something interesting this February: whale transactions to exchanges are hitting levels we haven’t seen in nearly five years. This pattern, if history is any indicator, often signals that Bitcoin’s price could soon skyrocket.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Try Watching the Whale Exchange Ratio

A particular metric to watch is the Whale Exchange Ratio, which measures the size of the top 10 inflows to exchanges against all inflows. On February 12th, this ratio hit 0.46, a jump from the 0.36 noted in mid-December when Bitcoin was flirting with all-time highs. According to CryptoQuant’s recent analysis, “Since late 2024, this metric has seen a robust upward surge, though its momentum has slightly moderated over the past two weeks without a definitive reversal,” says Grizzly, a contributor at CryptoQuant.

Miners also Join the Bullish Signals

Not just whales, but Bitcoin miners are showing bullish signs too. After six months of nearly continuous sell-offs, miners are now holding onto their coins. This could indicate a possible “capitulation” phase. Such phases are often seen as market bottoms, setting the stage for potential rallies.

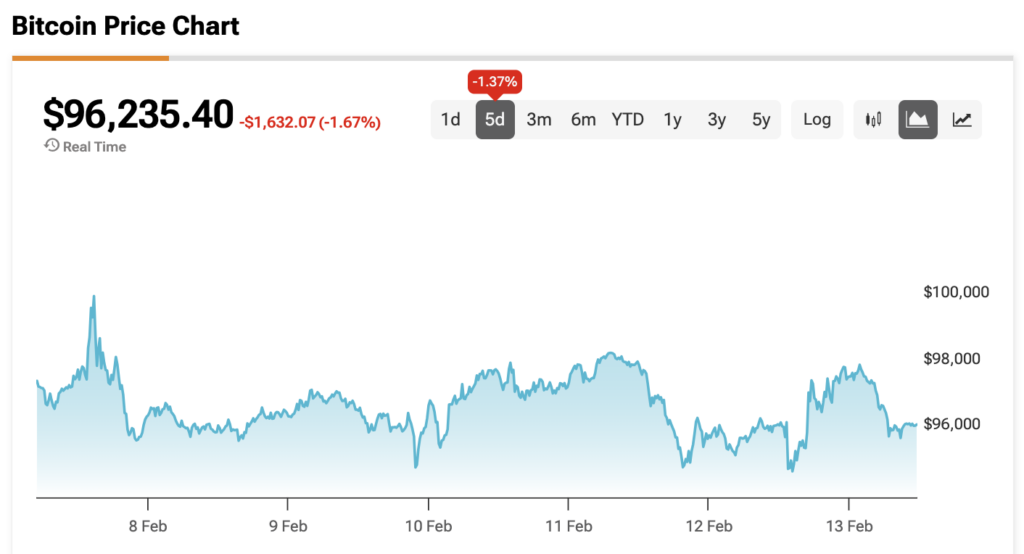

At the time of writing, Bitcoin is sitting at $96,235.40.