U.S. Bitcoin ETFs saw $240 million in new inflows on Thursday, breaking a six-day streak of outflows and giving traders a glimmer of hope despite the ongoing government shutdown.

Bitcoin Rebounds as ETFs Snap Six-Day Outflow Streak with $240 Million Boost

Story Highlights

U.S. spot Bitcoin exchange-traded funds finally snapped their losing streak on Thursday, recording $240 million in inflows. This was the first sign of relief after six straight sessions of redemptions that had weighed on market sentiment.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The inflows mark the first positive day since Oct. 28, according to data from Farside Investors, offering a brief pause to what has been one of the longest withdrawal stretches since the ETFs launched. Not a single provider reported outflows, ending a run that many analysts said was beginning to mirror the kind of capitulation seen near market bottoms.

Market Breathes as Outflows End

The new inflows come as Bitcoin (BTC) struggles to hold the $100,000 level amid the ongoing U.S. government shutdown. Since the shutdown began on Oct. 1, Bitcoin has fallen 11%, while the Nasdaq has gained 2% and gold is up 4%.

Historically, extended periods of ETF outflows have coincided with local bottoms for Bitcoin, suggesting that the recent selling pressure may have reached exhaustion. The previous record for consecutive redemptions was eight trading days, which preceded a rebound earlier this year.

Still, the broader backdrop remains fragile. The shutdown has drained liquidity from risk assets and dampened confidence across equities and crypto alike.

Shutdown Still Clouds Market Sentiment

According to Polymarket, there is roughly a 50% chance that the shutdown will continue beyond Nov. 16, keeping investors on edge and potentially limiting appetite for speculative trades.

In past cycles, prolonged political gridlock has aligned with key inflection points in Bitcoin’s market structure. The 2018–2019 government shutdown, for example, coincided with a multi-year bottom before a sharp rebound the following quarter.

Traders are now watching whether history repeats. Bitcoin’s current correction, which began on Oct. 6, has already erased 21% over 31 days. By comparison, the tariff-driven slump in April lasted 79 days and wiped out 32%.

Is This the Bottom, or Just a Pause?

While Thursday’s inflows offer some optimism, analysts caution that one green day does not signal a trend reversal. Persistent uncertainty over fiscal policy and the Federal Reserve’s next move continues to weigh on liquidity.

If ETF flows remain positive into next week, it could strengthen the case for a short-term floor around the $100,000 mark. However, another wave of redemptions could quickly reverse the sentiment shift.

For the time being, the brief return of inflows gives Bitcoin bulls a reason to breath (a little), but not yet a reason to celebrate.

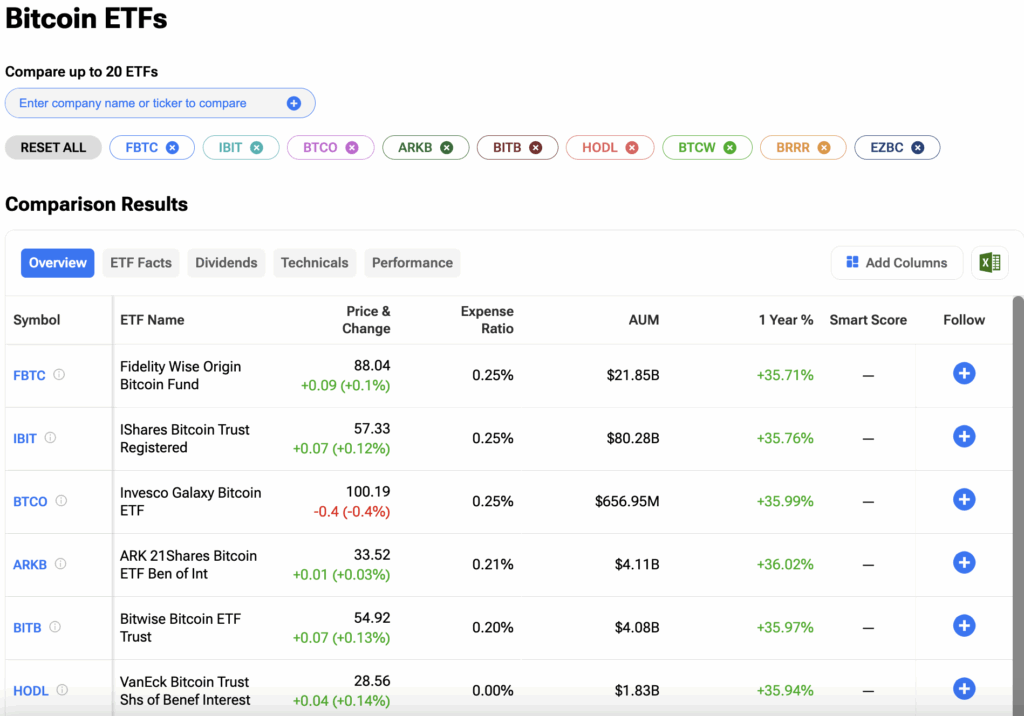

Investors can track their favorite Bitcoin ETFs on the TipRanks ETF Comparison Tool. Click on the image below to find out more.

1