Bitcoin (BTC-USD) prices surged over $24,500 as the CME Group (NASDAQ:CME), a leading derivatives marketplace, announced the expansion of its suite of event contracts by including Bitcoin futures. CME intends to provide a lower-cost way for investors to trade Bitcoin.

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Providing his views on the first day of trading of event contracts on Bitcoin futures, CME Group’s Global Head of Equity and FX Products, Tim McCourt, said the new contract offers a transparent and limited-risk way for individual investors to gain access to the “Bitcoin market via a fully regulated exchange.”

Digital currencies like Bitcoin have been viewed with skepticism. Thus, the launch of Bitcoin futures by a fully regulated exchange is a positive.

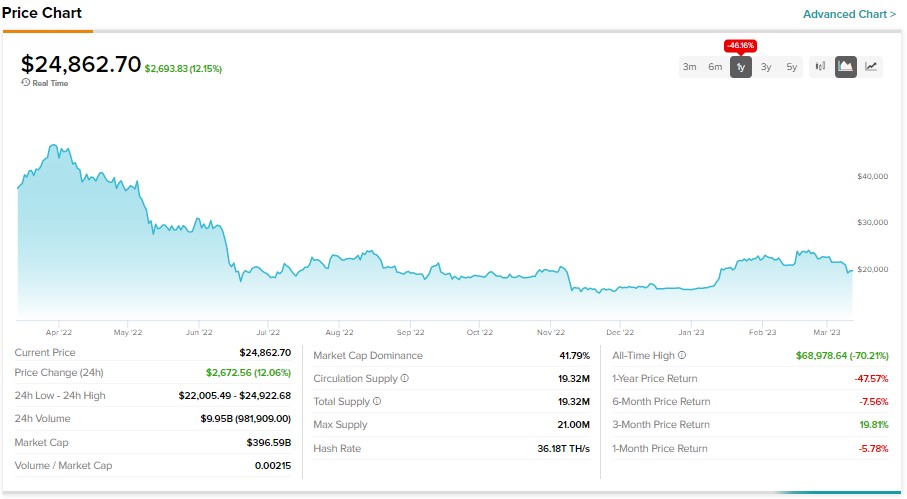

Notably, Bitcoin and other cryptocurrencies had a rough couple of years. Further, a growing regulatory crackdown on the crypto industry remained a drag on Bitcoin prices. Nonetheless, Bitcoin prices have surged in 2023, reflecting a year-to-date gain of over 48%.

However, investors should note that Bitcoin and other digital currencies remain highly volatile. Moreover, the macro-uncertainty and fear of recession could lower investors’ appetite for risk and lead to a decline in Bitcoin prices.