Bitcoin may be headed for choppy waters as escalating U.S.-China trade tensions threaten its short-term stability. The digital asset briefly dipped below $100,000 on February 4, as both nations announced retaliatory import tariffs, sparking fears of a full-blown trade war, according to Cointelegraph.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts Warn of Correction Risks

Market experts see potential for Bitcoin to correct below $90,000 if the broader economic landscape deteriorates. Ryan Lee, chief analyst at Bitget Research, noted that heightened volatility in traditional markets could either push investors to Bitcoin as a hedge or cause a sell-off in risk assets. “Escalating tensions may weaken traditional markets, prompting investors to seek Bitcoin… but broader uncertainty could still trigger short-term corrections,” Lee said.

Historical Trends Offer a Silver Lining

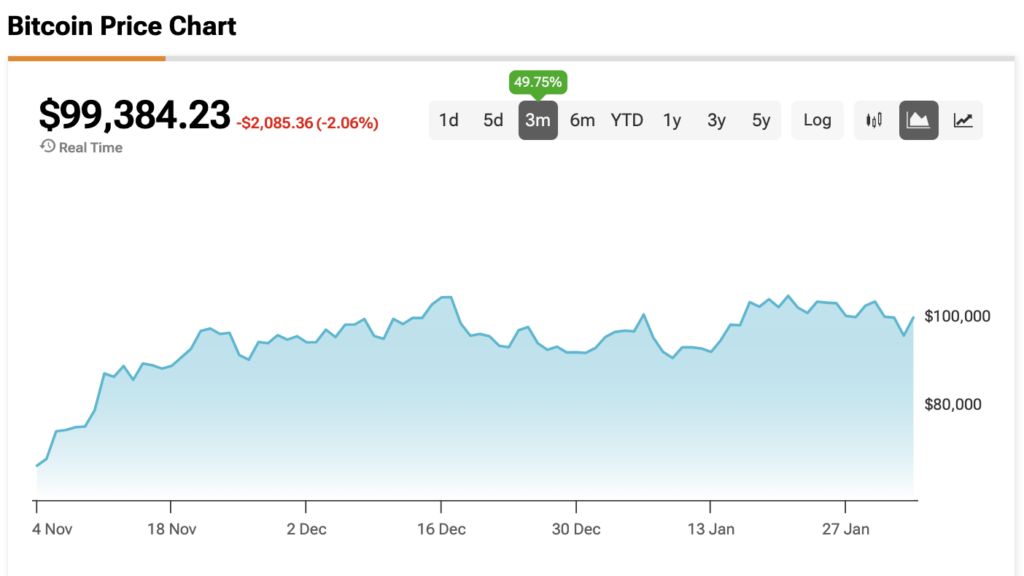

Despite the pressure, Bitcoin remains on track with historical cycles. The cryptocurrency is up 525% since the FTX collapse and continues to move within a channel between $90,000 and $109,000. CoinDesk analyst James Van Straten pointed out that Bitcoin’s trajectory still aligns with its 2017 cycle.

At the time of writing, Bitcoin is sitting at $99,384.23.