Bitcoin (BTC-USD) was buoyed for a while by plans to bring out a spot Bitcoin exchange-traded fund (ETF). Now, some resolution has been reached on that play and the news did not end well for Bitcoin. It didn’t end that badly for some cryptocurrencies, though, but cryptocurrency stocks took it on the chin in Friday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Bitcoin slipped slightly at the time of writing, though it was as volatile as it ever was, wavering between gain and loss in a matter of minutes. This time, the losses were prompted by a Securities and Exchange Commission (SEC) report that shot down BlackRock’s (NYSE:BLK) plans for the aforementioned ETF. The SEC called the filings supplied in aid of establishing the fund “inadequate,” noting that the applications were “not comprehensive,” according to a Wall Street Journal report.

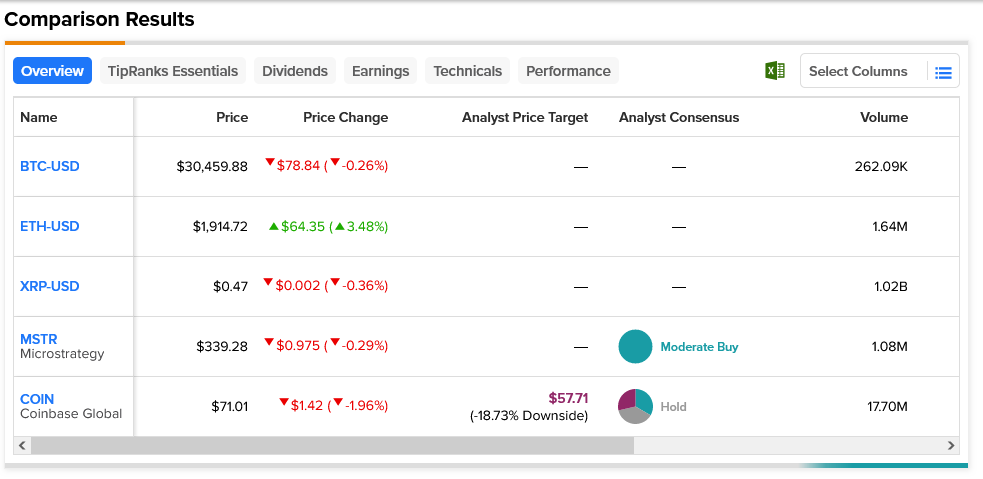

What was lacking in those reports, however, isn’t clear. But what is clear is that Bitcoin and other cryptocurrencies like Ethereum (ETH-USD) and Ripple (XRP-USD) gained over the last few weeks, though Bitcoin and Ripple were both down today. Ethereum, however, added 3.48% at one point in trading. Meanwhile, cryptocurrency related stocks like Microstrategy (NASDAQ:MSTR) and Coinbase (NASDAQ:COIN) were both down.

Interestingly, Microstrategy is considered a Moderate Buy by analyst consensus while Coinbase is a hold, likely due to Coinbase being a pure crypto play while Microstrategy has other offerings to fall back on. However, of the two, only Coinbase has a downside risk; it comes in at 18.73%.