Bitcoin (BTC-USD) has always been a volatile asset. Not long ago, it was toying with $50,000 a coin, and now, it’s struggling to stay above the $40,000 mark. The arrival of a range of new exchange-traded funds (ETFs) that trade in Bitcoin certainly helped. And today, it’s up just over 6%, bringing several Bitcoin stocks along with it.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

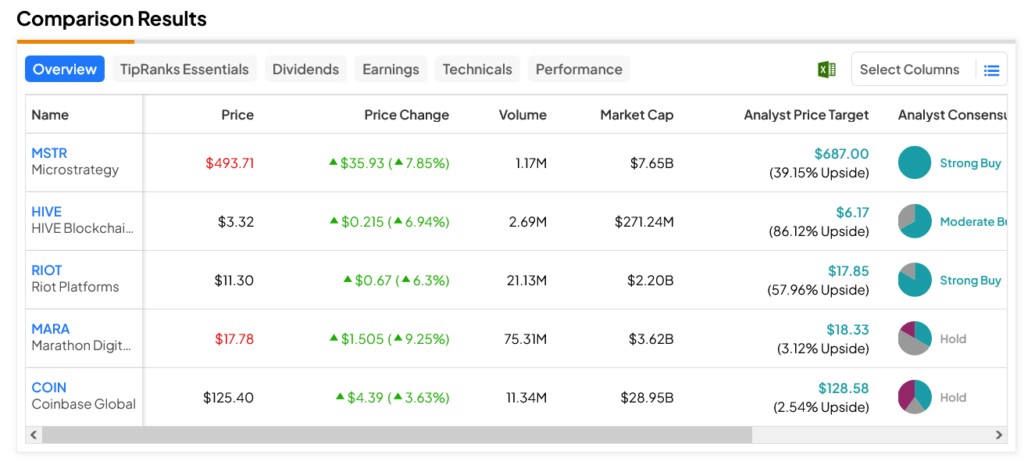

Coinbase (NASDAQ:COIN) added nearly 4%, and HIVE Blockchain (NASDAQ:HIVE) and Riot Platforms (NASDAQ:RIOT) posted over 6%. Microstrategy (NASDAQ:MSTR), which owns so much Bitcoin its share price frequently moves in sympathy with Bitcoin’s, was up nearly 8%. Finally, Marathon Digital (NASDAQ:MARA) added over 9% in Friday afternoon’s trading.

The reasons behind the sudden surge weren’t exactly clear, as the approval of spot Bitcoin ETFs has already been priced into the market for some time now. Following that, Bitcoin seemed to undergo what some called a “sell-the-news correction,” which sent prices back down. But the selling frenzy seems to have passed, at least for now, and Bitcoin prices are making their way back up once more.

Core Confidence Dropping?

In what may be a problem for Bitcoin—and the stocks so closely connected to it—there are signs of concern from retail investors. Yet, word from 10x Research’s head of research, Markus Thielen, suggests that now is “…not the time to turn bearish,” instead looking for positive catalysts from the U.S. election cycle to boost asset prices.

Which Bitcoin Stocks are a Good Buy Right Now?

Turning to Wall Street, HIVE stock is the clear leader right now. With an average price target of $6.17, this Moderate Buy-rated stock offers an upside potential of 86.12%. Meanwhile, COIN stock is the laggard, as this Hold-rated stock with an average price target of $128.58 can only offer a 2.54% upside potential.