The upward rise of Bitcoin (BTC-USD) continues apace, and it doesn’t seem like it can be stopped. It gained another 6% on Tuesday and managed to clear the $60,000 mark. Bitcoin’s rise has lifted several other cryptocurrencies and stocks, but one stock that didn’t get helped much was Bitcoin miner Riot Platforms (NASDAQ:RIOT), which is down over 2% in Wednesday morning’s trading.

Bitcoin cleared $60,000 per coin in yesterday’s trading and cleared the $61,000 mark as of this writing. What’s more, there are signs of further improvement to come as reports suggest that several other major Wall Street entities are moving to launch new exchange-traded funds (ETFs), this time focusing on Ethereum (ETH-USD). Long considered the silver to Bitcoin’s gold, Ethereum has drawn interest from such luminaries as BlackRock and Fidelity.

But What Happened to Riot Platforms?

With all this cryptocurrency frenzy in play, it would be easy to think that a crypto miner like Riot—which is basically in the business of making Bitcoin—would be on the rise, too. Yet, it’s not, and there are some potential reasons why. The biggest of these was the recent release of its full-year results, and the results weren’t great. Its $281 million in revenue was 2.7% lower than analysts projected.

However, it did do better on an adjusted earnings per share basis. Coming in at $0.47, it beat analysts consensus estimate of -$0.28. Still, it posted a loss of -$0.28 per share on a GAAP basis. Granted, the latest run-up would be better reflected in 2024’s year-end earnings, but for right now, Riot looks hurt.

What Is the RIOT Stock Forecast for 2025?

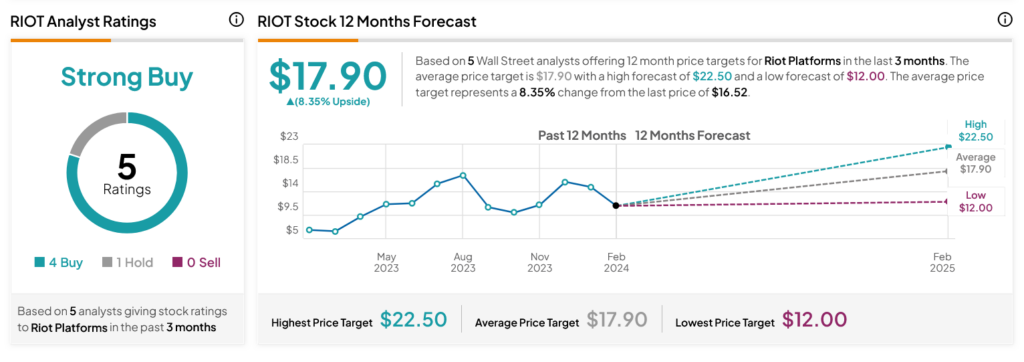

Turning to Wall Street, analysts have a Strong Buy consensus rating on RIOT stock based on four Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 168.89% rally in its share price over the past year, the average RIOT price target of $17.90 per share implies 8.35% upside potential.