Birchcliff Energy (OTC: BIREF) (TSE: BIR) declared a special dividend of C$0.20 per share. The special dividend is payable on October 28.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Based in Canada, Birchcliff Energy is an intermediate oil and natural gas company that engages in the exploration, development, and production of natural gas, crude oil, and natural gas liquids (NGLs).

Over and above the special dividend, the company reaffirmed its plans to pay out dividends of C$0.80 per share by 2023. Currently, it pays quarterly dividends of C$0.02 per share.

On top of that, the company also hiked its annual capital spending budget by C$80 million to the range of C$355 million to C$365 million.

Birchcliff CEO Jeff Tonken commented, “This further capital investment in our business will help to ensure the most efficient execution of our 2023 capital program and will not increase our 2022 annual average production.”

Is Birchcliff Energy a Good Stock to Buy?

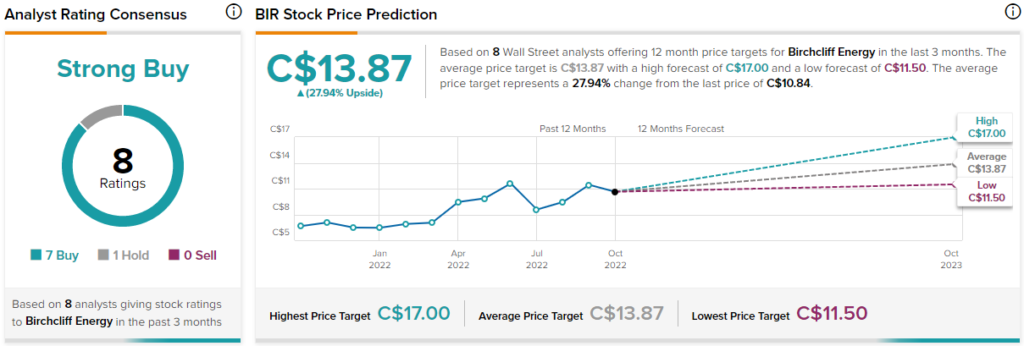

The analyst community is clearly optimistic about the stock. Overall, Birchcliff Energy stock commands a Strong Buy consensus rating based on seven Buys and one Hold. Birchcliff Energy’s average price target of C$13.87 implies 27.9% upside potential from current levels.

Notably, BIREF stock has a ‘Perfect 10’ Smart Score on TipRanks, indicating that the stock has strong potential to outperform market expectations, going forward.