Shares of biopharmaceutical company BioXcel Therapeutics (NASDAQ:BTAI) are down a massive 62% at the time of writing today even after it announced positive topline results from a Phase 3 study evaluating BXCL501 for the treatment of Alzheimer’s disease-associated agitation.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

At 60 mcg dose, the study reached its primary as well as the first key secondary endpoint. Nonetheless, it failed to achieve the other key secondary endpoints.

The drug was observed to be well tolerated and the company is now planning for a potential sNDA submission in the second half of this year.

Despite this progress, investors are alarmed over an investigator’s actions at a study site which has raised questions over the reporting of a serious adverse event in the placebo arm of the study. Additionally, the U.S. Food and Drug Administration (FDA) had also raised observations about the investigator’s failure to adhere to certain requirements and guidelines.

Consequently, BioXcel is now conducting an investigation into the data integrity at the concerned trial site.

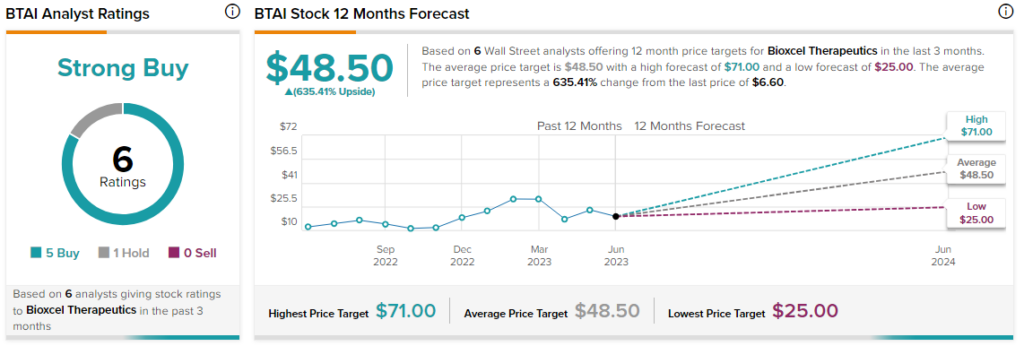

Overall, the Street has a $48.50 consensus price target on BTAI alongside a Strong Buy consensus rating. This points to a massive 635% potential upside in the stock after today’s price erosion.

Read full Disclosure