Shares of BioNTech (BNTX) rose 5.6% at the time of writing after the company reported upbeat fourth-quarter results.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Based in Germany, BioNTech develops and manufactures next-generation therapies for cancer, allergies, and autoimmune disorders. Its portfolio of oncology product candidates includes individualized and off-the-shelf mRNA-based therapies.

Q4 Results

Revenues during the quarter stood at €5.53 billion, compared to €345.4 million in the same quarter last year. The increase was witnessed on the back of strong sales of its COVID-19 vaccine worldwide.

In addition, BioNTech delivered a net profit of €3.17 billion, up from €366.9 million reported in the year-ago quarter.

During the quarter, the company incurred research and development (R&D) expenses of €271.5 million, up 5.6% year-over-year. Also, general and administrative expenses (SG&A) increased 264.6% to €130.9 million.

Outlook

For the full year 2022, BioNTech expects COVID-19 vaccine revenue in the range of €13 billion and €17 billion.

Also, it expects to spend €1.4 billion to €1.5 billion on R&D during the year, up 50% compared to 2021. SG&A expenses and capital expenditures are each projected to be between €450 million and €550 million.

Capital Deployment Plans

BioNTech seeks to initiate a share repurchase program of up to $1.5 billion for a period of two years. Further, it plans to announce a special cash dividend of €2 per share for approval at its upcoming 2022 Annual General Meeting.

Stock rating

Consensus among analysts is a Hold based on two Buys and six Holds. BioNTech’s average price target of $276.86 implies 60.6% upside potential to current levels. Shares have gained 65.1% over the past year.

Blogger Opinion

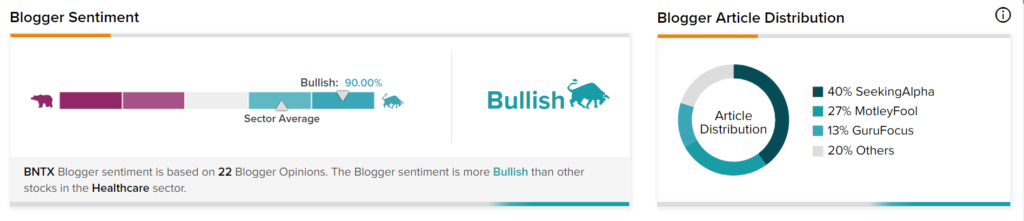

TipRanks data shows that financial blogger opinions are 90% Bullish on BNTX, compared to the sector average of 71%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Uber and bp Team Up, Will They Deliver?

Mighty Micron Manages Quarterly Earnings Mastery

Why Did Nielsen Holdings Rise Over 20%?