Shares of biotechnology company BioNTech SE (NASDAQ:BNTX) are rising upward at the time of publishing today after the company posted robust first-quarter numbers.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The company’s first-quarter revenue declined 79.7% year-over-year to €1.3 billion but still landed ahead of estimates by nearly €210 million. Additionally, EPS at €2.05 outperformed expectations by about €1.35.

The drop in the topline was attributable to lower COVID-19 vaccine sales globally. Looking ahead, for full-year 2023, the company expects revenue from COVID-19 vaccine sales to hover at €5 billion. Capital expenditures for the year are anticipated between €500 million and €600 million.

Furthermore, BNTX plans to begin a Phase 3 study evaluating BNT316 for the treatment of non-small cell lung cancer (NSCLC) in patients with progression after PD-1/PD-L1 treatment.

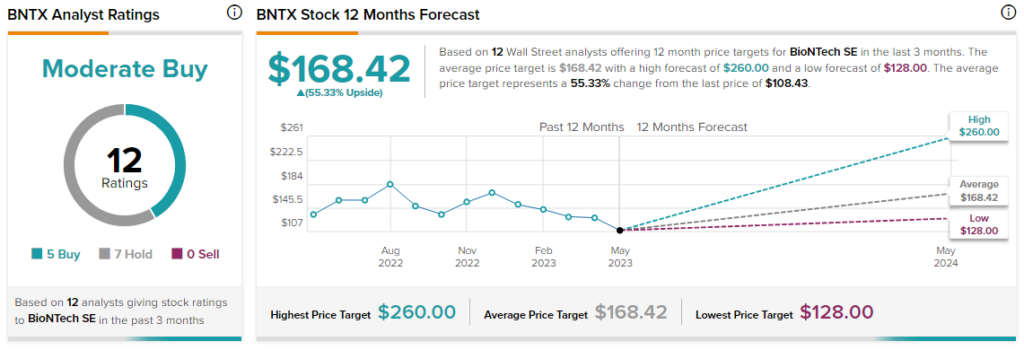

Overall, the Street has a $168.42 consensus price target on BNTX pointing to a 55.33% potential upside in the stock.

Read full Disclosure