Shares of BioNTech SE (NASDAQ: BNTX) fell in pre-market trading on Monday after the biotech company reported Q4 diluted earnings of €9.26 per share versus €12.18 in the same period last year and beating analysts’ expectations of €7.75.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s Q4 revenues, however, declined by 22.6% year-over-year to €4.28 billion, surpassing consensus estimates by €420 million.

In FY23, BNTX expects COVID-19 vaccine revenues of approximately €5 billion. Moreover, the company also expects to authorize a stock buyback program of up to $0.5 billion during the remainder of 2023.

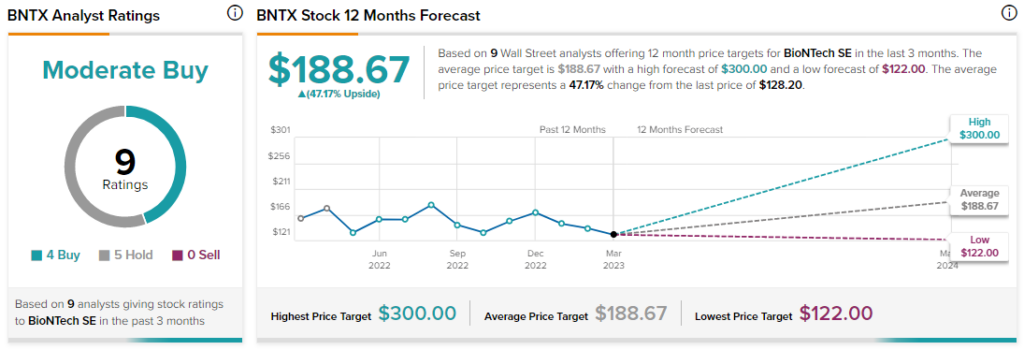

Overall, Wall Street analysts are cautiously optimistic about BNTX stock with a Moderate Buy consensus rating based on four Buys and five Holds.