Yesterday, we heard about biotech stock Biogen (NASDAQ:BIIB) and its partners in Japan rolling out a new treatment for Alzheimer’s disease there, the second country the treatment in question had seen. Now, Biogen’s got a new treatment coming out. It wasn’t enough to salvage the stock, however, as Biogen shares were down fractionally in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new treatment, developed in conjunction with Sage Therapeutics (NASDAQ:SAGE), targets a major problem among women: postpartum depression. For those not familiar, it’s a condition that occurs immediately after pregnancy, specifically, the birth of the child. Symptoms include sadness, anxiety, and tiredness that lasts for a significant amount of time after giving birth. But the new treatment, zuranolone—marketed under the slightly less cumbersome name Zurzuvae—should help address that issue. It’s an oral treatment with two 25-milligram capsules taken daily over the course of 14 days.

Another Potential Winner

Early tests suggest that Zurzuvae not only works, but it works pretty quickly. While it’s a 14-day treatment cycle, some women have found relief in as little as three days. Zurzuvae came a long way over the course of its creation; reports note that the early versions were rejected at the Food and Drug Administration (FDA), as it couldn’t effectively treat of major depressive disorder (MDD) along with postpartum depression. But it seems to be ready for prime time now, and it should mean another hit for Biogen. A full 14-day course of Zurzuvae will run $15,900, reports note, though insurance will almost certainly get involved therein. Had Zurzuvae also treated MDD, the price would have roughly tripled.

Is Biogen a Buy, Sell or Hold?

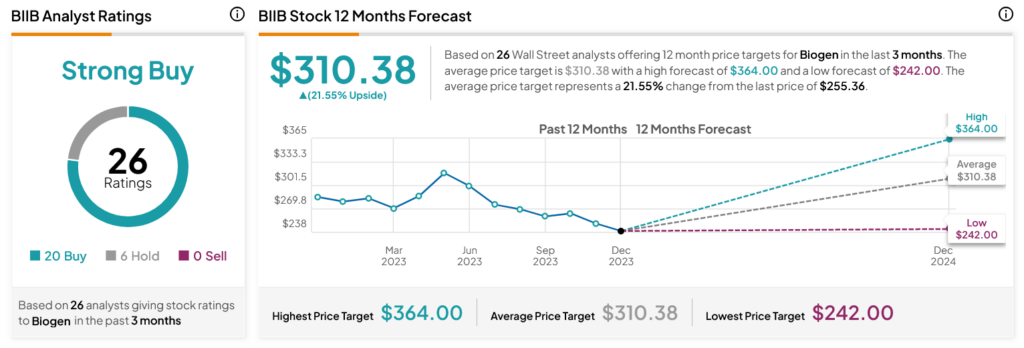

Turning to Wall Street, analysts have a Strong Buy consensus rating on BIIB stock based on 20 Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 10.02% loss in its share price over the past year, the average BIIB price target of $310.38 per share implies 21.55% upside potential.