It’s the end of an era at biotech stock Biogen (NASDAQ:BIIB), as it plans to phase out a treatment for Alzheimer’s disease: Aduhelm. Despite losing a potential line of business in a market that could sorely use it—no one wants to lose a family member to a disease that may not kill them but makes them the next worst thing: forgotten—investors aren’t taking this news poorly. In fact, Biogen stock is up fractionally in Wednesday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Biogen is pulling the plug on a “post-approval study” of Aduhelm and giving back the licensing rights after it couldn’t find anyone to help shoulder the costs of going through the standard set of hoops that is regulatory approval. That, plus the comparatively long lead time to get Aduhelm to market, left Biogen in a bit of a pickle: should it go ahead and pay the hefty costs involved to get the drug approved and to market, running the risk that, by then, someone else would leapfrog them and take first-mover advantage? Or should it instead cut its losses and pursue other venues? The latter was the route Biogen took, and given shareholder response, it seems to be the right one.

What’s Next for Biogen?

But Biogen won’t be eschewing all development. In fact, reports note, it’s already got a replacement line of business waiting in the wings. Instead of trying to get Aduhelm ready to go and possibly arriving too late to do much good, it will focus on Leqembi, a recently approved Alzheimer’s drug. It’s also got a set of “experimental treatments” planned, so Biogen isn’t departing the market so much as it is changing the vehicle in which it gets to said market.

Is BIIB a Buy or Sell?

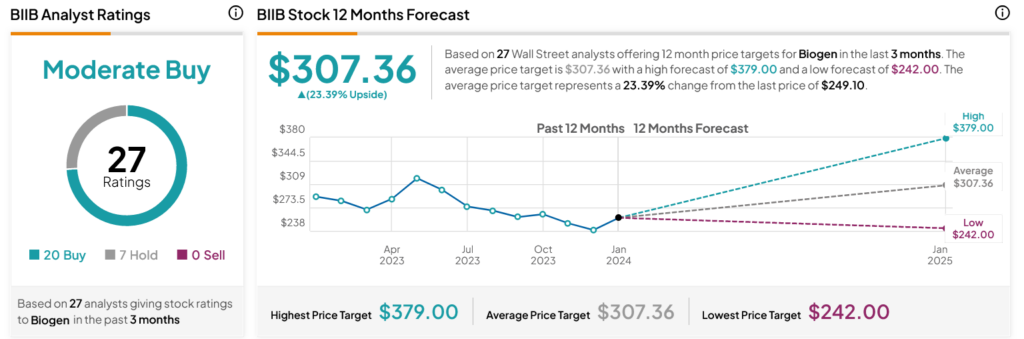

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BIIB stock based on 20 Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 14.77% loss in its share price over the past year, the average BIIB price target of $307.36 per share implies 23.39% upside potential.