Biogen’s (NYSE:BIIB) Alzheimer’s drug, lecanemab, developed jointly with Eisai (OTC:ESALY), might have more risks than a cure. Researchers studying the drug and its effects on about 1,800 early-stage Alzheimer’s patients revealed some key details that might determine whether the U.S. Food and Drug Administration (FDA) approves the drug. The researchers called for a longer and deeper study of the drug.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

It was revealed that the drug’s effect was moderate, and cognitive decline was slowed by 27% in the patients who were administered the drug, compared to patients placed on placebo for 18 months. Nonetheless, the lecanemab caused bleeding in 17.3% of patients on the drug versus 9% on the placebo. Not only that, but brain swelling in 12.6% of patients on lecanemab was another cause for concern, especially as only 1.7% of patients on a placebo faced the same issue.

Earlier, both the developing companies requested conditional approval of lecanemab on the basis of a prior study that revealed reduced levels of amyloid in the brains of patients using the drug. Importantly, amyloid is a protein whose levels in the brain determine the degree of the disease in Alzheimer’s patients.

Some doctors are concerned about whether the drug’s effectiveness could outweigh the potential risks to patients. They suggested that deeper and prolonged research might be necessary to determine the medical effectiveness of lecanemab.

Into the bargain are the recent reports of two deaths in study-respondent patients who were taking lecanemab. While doctors speculate that the deaths were caused by the drug, Eisai assures that the patients had other serious medical problems that were more likely to have caused their deaths.

Lecanemab is a highly anticipated Alzheimer’s drug that has kept Biogen and Eisai in focus as potential game-changers. However, failure to get approval might spark investor concerns.

Is BIIB a buy or sell?

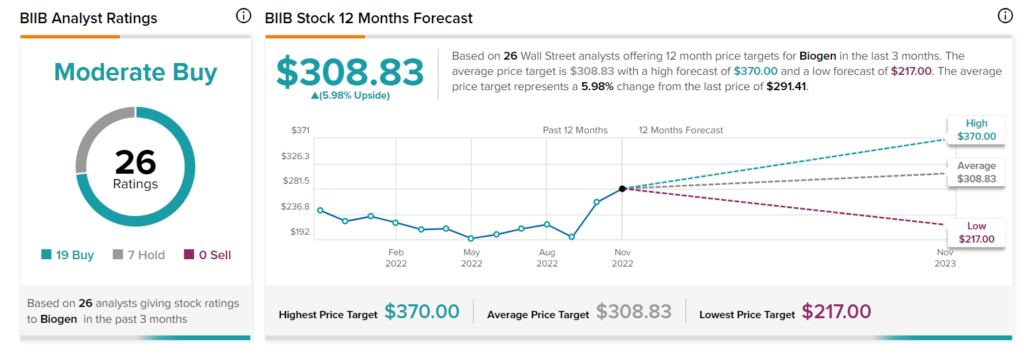

Wall Street is cautiously optimistic about Biogen, with a Moderate Buy rating based on 19 Buys and seven Holds. The average price target of $308.83 indicates an upside of 6% from current price levels over the next year.