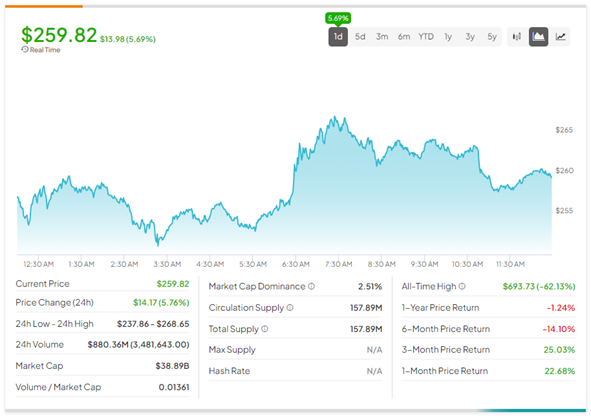

The world’s largest cryptocurrency exchange, Binance Holdings, could end up paying over $4 billion to the U.S. Department of Justice (DOJ) to end all criminal charges against it. Binance’s crypto token, BNB-USD, gained 5.7% on the news yesterday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Binance and its founder Changpeng Zhao (CZ) are being probed on multiple counts of money laundering, bank fraud, and violation of U.S. sanction laws. Further, Binance is also alleged to be involved in routing cryptocurrency to help finance Hamas’ war against Israel. The final settlement details could come as early as the end of November, a Bloomberg report stated.

Even if Binance agrees to pay the fine to clear its name, founder CZ could still continue to face criminal charges in the U.S. The $4 billion fine would become one of the largest settlements so far in the crypto industry’s history. The DOJ could also impose more conditions or sanctions on the firm before cleaning the slate. The end of the years-long investigation is seen as a positive by the investors who pushed the BNB token up yesterday.

Is there a Future for BNB?

The series of lawsuits both in the U.S. and Europe, the exit of high-profile executives, and workforce reductions have taken a toll on BNB. The value of BNB-USD has plunged 15.4% in the past six months. Further, BNB is trading at a 62.1% discount to its all-time high value of $693.73, touched on November 8, 2021.

Even so, the BNB token could gain momentum if the firm goes ahead with the DOJ settlement and regains customer confidence by operating within the rules.