Crypto exchange Binance (BNB-USD) continues to witness an exodus of senior executives, as a regulatory crackdown intensifies in the U.S. and other markets. Mayur Kamat, Binance’s head of product, is the latest senior executive to leave the company.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

As per media outlet Cointelegraph, Kamat stepped down to take a break following 20 years of “non-stop product work.” Kamat, who joined Binance as head of product in January 2022, previously worked as a product manager at companies like Alphabet (NASDAQ:GOOGL, GOOG) and Agoda.

Executive Exodus at Binance

Kamat’s exit follows the recent departures of chief strategy officer Patrick Hillman, general counsel Han Ng, senior director of investigations Matthew Price, senior vice president for compliance Steven Christie, and U.S.-based chief business officer Yibo Lang. Further, last week Bloomberg reported the resignation of Binance’s Asia-Pacific head Leon Foong.

In July, several reports emerged that Binance laid off more than 1,000 employees. Responding to the news, Binance’s CEO Changpeng Zhao tweeted, “The numbers reported by media are all way off.” He said that there were involuntary terminations as well in the company.

It is worth noting that in June, the U.S. Securities and Exchange Commission (SEC) sued Binance and Zhao, alleging that they were operating a “web of deception.” The SEC also sued rival crypto exchange Coinbase (NASDAQ:COIN). Both the exchanges were accused by the SEC of offering unregistered securities in violation of federal securities laws.

Aside from the SEC, the U.S. Commodity Futures Trading Commission (CFTC) also filed a lawsuit against Binance earlier this year, accusing the company of operating an illegal digital exchange. Last week, the Wall Street Journal reported that Binance is evaluating options for its Russian business, including fully exiting the country due to regulatory woes.

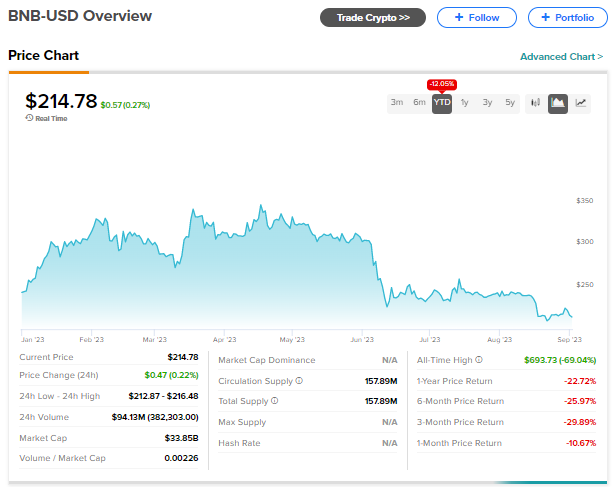

Regulatory pressure seems to have weighed on BNB-USD, Binance’s native token, which has declined 12% year-to-date.